Global Context and Regional Outlook for Latin America and the Caribbean, Presented by Anoop Singh, Director, Western Hemisphere Department, IMF

October 13, 2005

Presented by Anoop Singh

Director, Western Hemisphere Department

International Monetary Fund

At a symposium sponsored by the Banco de la Republica

Bogota, Colombia, October 13, 2005

Executive Summary

The world economy is expected to remain supportive for the Latin American and Caribbean (LAC) region. While global activity has moderated in 2005, the short-term outlook looks solid and global GDP growth is projected to remain above trend at 4¼ percent in 2005 and 2006. This reflects, in part, the resilience of the U.S. economy in the face of recent hurricanes and high oil prices. Although risks are now tilted to the downside, still accommodative monetary and fiscal stances, the ongoing improvement of corporate balance sheets, and favorable financial market conditions are expected to underpin global growth. The Latin American region-which continues to benefit from strong commodity prices-is projected to grow above trend at 4 percent and 3¾ percent in 2005 and 2006, respectively.

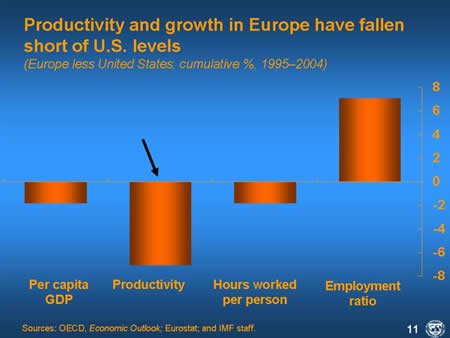

The current expansion in the LAC region appears more resilient than previous upturns. Many countries have seized the opportunity to reduce public debt/GDP ratios by implementing significant structural adjustments in their fiscal positions. Current accounts are in surplus, reducing dependence on external capital inflows, and external reserves have increased. Governments have taken advantage of the benign international financial conditions to prefinance external debt service obligations and strengthen maturity profiles. Strengthened macroeconomic policy stances and economic fundamentals have increased governments' access to domestic currency bond markets. Finally, monetary policy frameworks have been bolstered by the adoption of inflation targets and the generally increased commitment to exchange rate flexibility.

Although the short-term outlook is generally positive, there is considerable differentiation between countries depending on individual economic and political circumstances, and there are important downside risks. Key among the external risks is the possibility of a sharper-than-expected slowdown of growth in key trading partners or international trade, possibly triggered by a continued surge in oil prices and/or rising protectionist sentiment. The region also remains vulnerable to an abrupt tightening of global financial market conditions, as debt ratios still remain high in many countries and there remains a high dependence on exchange-rate linked and short-term instruments.

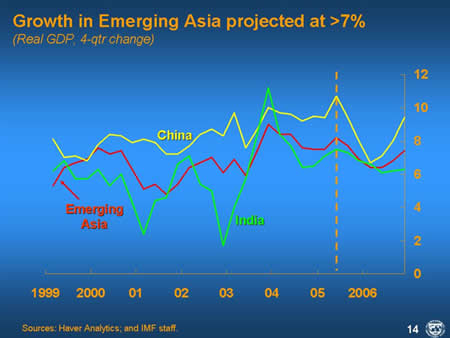

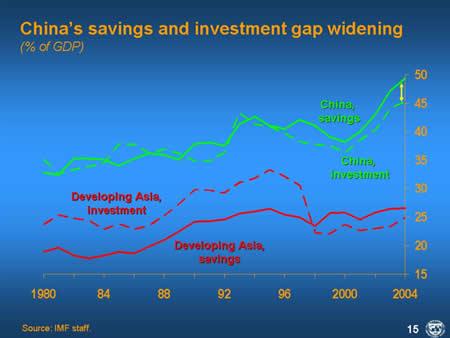

At the same time, the current juncture still provides a continuing window of opportunity to further strengthen underlying policy positions and boost the region's growth potential. This would involve a sustained policy commitment to entrench macroeconomic stability, most notably by further reducing public debt burdens and maintaining low inflation. The policy agenda also should involve deepening structural reforms to eliminate impediments to private investment and entrepreneurship. Key priorities on the structural front include: (i) financial sector reform; (ii) greater trade openness and foreign direct investment; (iii) efficiently managing and using natural resources; and (iv) strengthening the business climate. The coming heavy electoral calendar provides countries in the region with an important opportunity to deepen mandates in these areas.

I. The Global Context

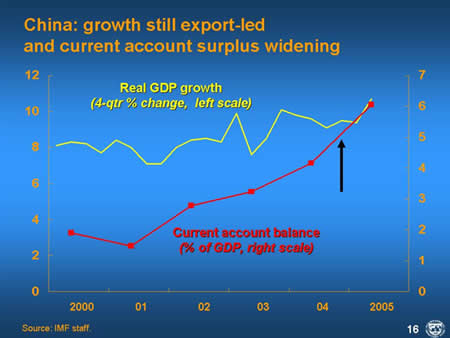

A. Trends and Prospects

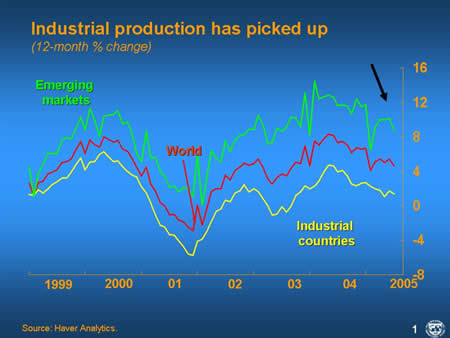

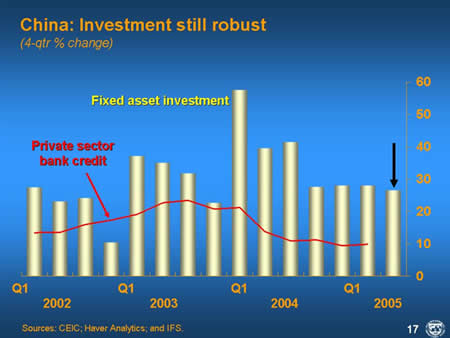

1. The global economy has been robust over the past year and a half. (Figure 1) 2004 saw the strongest performance in three decades, with world output increasing by 5.1 percent. In 2005, global activity has moderated to a more sustainable pace and remains broadly on track, despite a number of recent shocks. In particular, we have seen a modest slowdown in the second quarter of 2005, in part reflecting the impact of higher oil prices, but the services sector in most countries has remained strong, and recent indicators suggest that manufacturing and trade growth are picking up again. Although there are elevated risks ahead, which are discussed below, our central scenario is one of continuing robust global growth, which is projected to remain above trend at over 4¼ percent in 2005 and 2006.

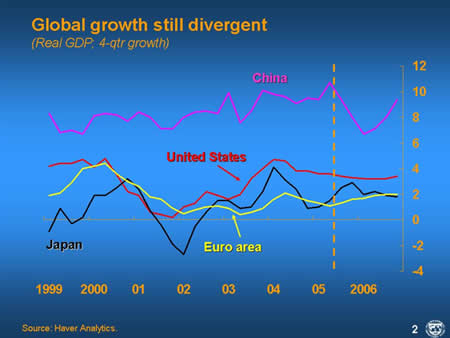

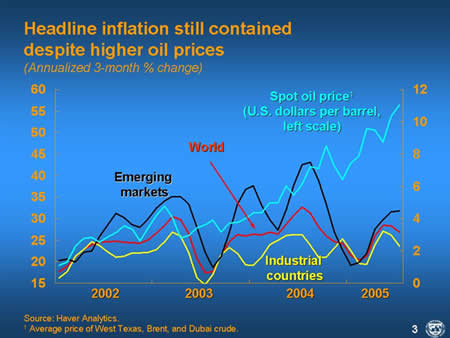

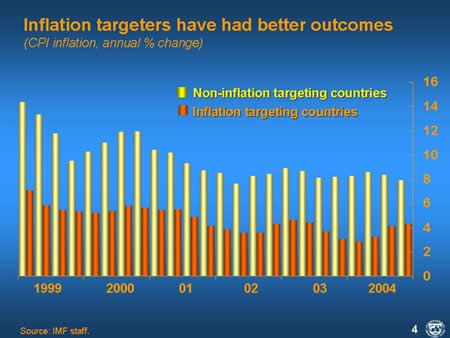

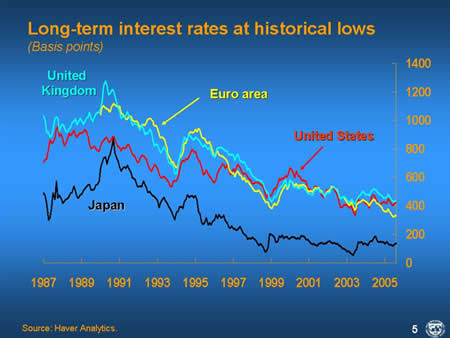

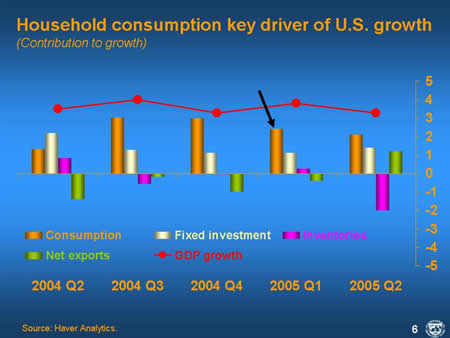

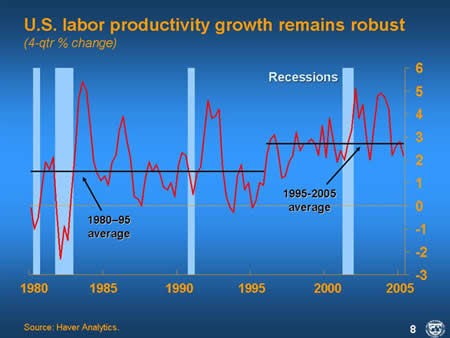

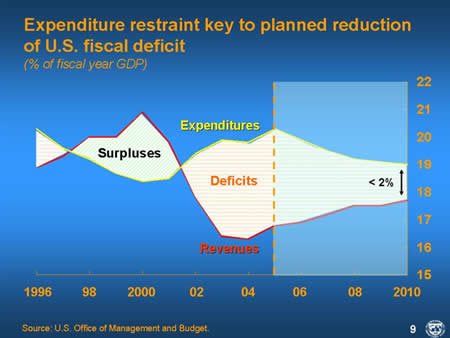

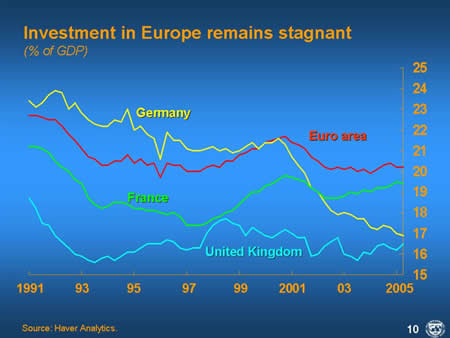

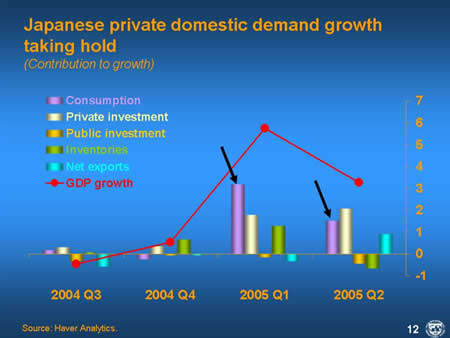

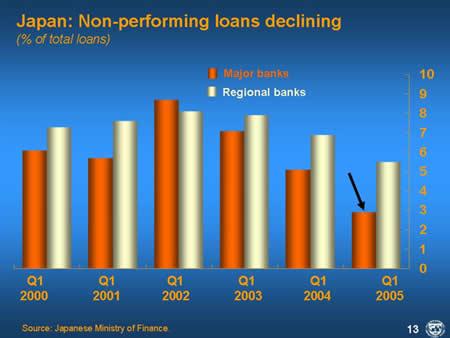

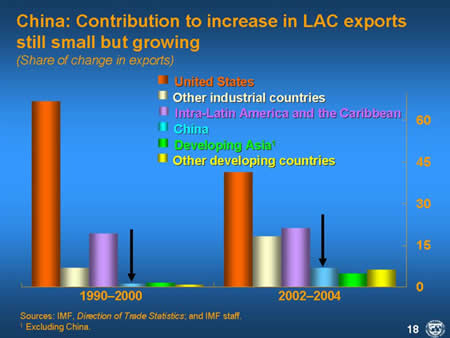

2. Within this broad picture, divergences across regions remain wide, with the United States and China continuing to lead the expansion. (Figure 2) In the United States, real GDP is projected to rise by about 3½ percent in 2005, and ease only modestly to around 3¼ percent in 2006, despite recent shocks, including Hurricane Katrina and much higher oil prices. In China, growth is projected at 8½-9 percent in 2005 and 2006, reflecting continued rapid growth of manufactured exports, including textiles. Growth in the euro area, on the other hand, is expected to be disappointing, averaging under 2 percent in 2005-06. In most other regions, growth prospects have also tended to weaken-although those for Japan and India have brightened.  3. Global headline inflation has picked up slightly, but remains contained, despite higher oil prices. (Figure 3) Among the major industrial countries, core inflation indices appear generally contained, inflationary expectations well-anchored, and wage increases moderate. However, asset prices-especially housing-bear close watching as low interest rates may be pushing valuations beyond medium-term fundamentals. In emerging market countries (EMCs), inflationary pressures have risen somewhat more than in the industrial countries, reflecting generally less well-anchored inflationary expectations, even though in many of these countries higher international oil prices have still not been fully passed through to domestic consumers. It is noteworthy that EMCs with inflation-targeting regimes seem to have been more successful in keeping inflation low, without visible adverse effects on growth. (Figure 4)   4. Financial markets conditions remain favorable. (Figure 5) More than one year into the U.S. monetary tightening cycle, long-term interest rates and credit spreads have stayed low, reflecting the strength of savings (especially from emerging markets), historically high corporate profits in industrial countries, and levels of private nonresidential investment that appear to have lagged cyclical norms. As a result, liquidity has been ample, equity markets are generally up, and the "search for yield" continues to support valuations of riskier assets and to encourage leverage. Thus, emerging market financing conditions have been very favorable, with most EMCs having started to pre-finance 2006 needs. Coupled with improved fundamentals and a widening long-term-oriented investor base, these factors have strengthened many countries' resilience.  B. Industrial Countries United States 5. Growth has been remarkably resilient in the United States, with private consumption continuing to provide strong support. (Figure 6) Solid gains in employment (outside manufacturing) and disposable incomes and higher housing wealth have helped boost household demand, albeit coupled with a further drop in the saving rate. The growth of personal consumption is projected to moderate in the second half of 2005 and into 2006, especially given the recent surge in oil prices, recent monetary tightening, the advanced state of the housing cycle, and disruption from Hurricane Katrina. However, the U.S. corporate sector, with continuing record profits and cash flow, underpinned by solid productivity growth, has the ability to increase investment and, thereby, its support to growth, provided business confidence remains high. (Figures 7/8) As such, U.S. GDP growth is projected to remain the highest in the G-7.    6. Despite the catastrophic effects of hurricane Katrina on life and property and its near- term fiscal impact, the overall direct effect on U.S.-and global-GDP growth is likely to be limited. Growth in the United States will be reduced somewhat in the coming months, but will then receive a boost as reconstruction spending accelerates. However, Katrina has added to the downside risks facing the U.S. economy, where the low household savings rate leaves consumer confidence and consumption vulnerable to price shocks. In addition, the significant additional spending commitments that have been made for relief and reconstruction have illustrated the risks to the Administration's fiscal consolidation strategy-of halving the budget deficit to under 2 percent of GDP by FY 2009-and the heavy burden that has been placed on expenditure discipline. (Figure 9)  Euro Area and the United Kingdom 7. Economic performance across the euro area remains very diverse and there has been some deterioration in the growth outlook since April. In particular, domestic demand faltered in the first half of 2005, after showing signs of revival in late 2004, and second quarter consumption and investment indicators weakened, especially in France and Germany. (Figure 10) Overall, GDP growth averaged only about 1½ percent in the first half of the year. Nevertheless, there are signs of a rebound in the second half of 2005. In particular, industrial production and corporate balance sheets have strengthened, which will provide support for investment, and export performance appears to have improved. Against this background, and that of generally supportive global trends, the euro area should gradually regain momentum, with GDP growth in the area projected to rise from 1.6 percent in 2005, to 2.1 percent in 2006.  8. GDP growth in the United Kingdom has proved weaker than expected. Private consumption growth slowed sharply in the first half of 2005, in part reflecting higher interest rates, oil price increases, and the cooling housing market. Against this backdrop, and in light of weakening business confidence, GDP growth is now projected at 1.9 percent in 2005-0.7 percentage point lower than expected in April-before recovering to 2.2 percent in 2006. 9. A long-standing and core challenge for Europe is to raise potential growth. (Figure 11) Europe's per capita GDP has remained at levels that are only 70 percent of those in the United States for the past 30 years, and structural reform is needed to boost incomes. The agenda varies across countries in Europe but includes everywhere policies to increase labor market flexibility and labor utilization, outcomes that would also improve the solvency of national pension systems. Such an agenda, by achieving investment-driven increases in GDP growth, would also assist in the cooperative strategy aimed at promoting more balanced global growth.  Japan 10. The Japanese economy expanded relatively strongly in the first half of 2005 and this momentum should continue in the period ahead. (Figure 12) Rather than net exports, it is private final domestic demand-both consumption and business investment-that is driving the current expansion, supported by a strengthening labor market and high corporate profitability. The considerable progress of recent years in addressing weaknesses in the bank and corporate sectors-as manifested by the decline in non-performing loans-has put the economy in a better position to sustain an expansion. (Figure 13) Thus, the positive outlook is helped by rising business confidence and investment intentions, and recent progress in reducing inventories and excess capacity. Consequently, real GDP is now projected to expand by 2 percent in both 2005 and 2006. Looking ahead, maintaining the Japanese expansion will require-as in Europe-structural reforms to raise productivity, through greater domestic competition and labor market flexibility. Such an agenda would also help secure an orderly resolution of global current account imbalances, minimizing, in particular, any negative impact on global growth of the fiscal adjustment that is necessary in Japan.   C. Emerging Markets and Developing Countries 11. Emerging market and developing countries should continue to show robust growth, albeit at a reduced pace relative to the strong expansion recorded in 2004. (Figure 14) Activity in emerging Asia is being led by China and India, whose growth is expected to be 9 percent and 7 percent, respectively, in 2005, with a moderate easing in these two countries in 2006. Nevertheless, China's export-led growth has contributed to a widening of its savings-investment gap relative to the rest of Asia. (Figure 15) The Latin America and Caribbean region is continuing to grow well above historical averages and I will elaborate on our region shortly. Elsewhere, Africa has maintained relatively robust growth, while Middle East projections have been raised with the rise in oil prices. In the transition countries, especially Russia, as well as in emerging Europe, growth has slowed in 2005, reflecting a range of factors including capacity constraints and weak demand from Western Europe.   12. The good news is that most EMCs have used the favorable global context of recent years to reduce vulnerabilities. In particular, since 2002, fiscal balances have strengthened and public debt ratios have declined in three quarters of EMCs. External vulnerabilities have also eased, with improving current accounts and reserves, including in many oil-importing countries. In the financial and corporate sectors, balance sheets have strengthened. While some of these improvements reflect cyclical factors, it is also the case that there has been sustained improvement in key fundamentals-although debt burdens remain a concern in many countries. China 13. Let me say a little more on China whose situation and outlook provide both opportunities and challenges for Latin America. (Figure 16) In China, economic expansion continues unabated, with GDP growth running at 9½ percent (year-on-year) through the first half of 2005. We now forecast an expansion of 9 percent for the entire year of 2005, and a moderate easing to 8½ percent for 2006. The composition of domestic demand growth has shifted somewhat, with the relative contribution from private consumption rising, although lately net exports have been showing greater momentum relative to total domestic demand. As a consequence, China's current account surplus has continued to rise, and may exceed 6 percent of GDP this year.  14. It is noteworthy that investment remains very strong in China, growing at 27 percent through end-July (year-on-year)-even after a series of administrative and monetary tightening measures taken in 2004. (Figure 17) Looking ahead, China faces the core challenges of slowing investment and improving its quality, while increasing consumption demand, and reducing reliance on ever larger external surpluses for sustaining growth. The exchange rate reform in July-comprising an initial 2 percent revaluation of the renminbi, a shift to setting the central rate with reference to a currency basket, and an allowable daily fluctuation rate of 0.3 percentage point against the U.S. dollar-is an important step toward greater flexibility, which, if fully utilized, should also facilitate the conduct of monetary policy in the period ahead.  15. Coming to China's links with Latin America, China accounted for 7 percent of the increase in Latin American and Caribbean exports over the past two years. (Figure 18) This modest figure masks, however, the importance of China for some key Latin American exports, such as copper and soybeans, where China accounts for about a fifth of world consumption. China's robust growth has spurred higher prices for these products, benefiting exporters such as Argentina, Brazil, Chile, and Peru. China's thirst for natural resources has also boosted oil prices, benefiting net oil exporters such as Colombia, Ecuador, Mexico, Venezuela, and Trinidad and Tobago and has the potential to raise China's investments in Latin America. At the same time, China is providing considerable competition in some export markets, in particular in textiles and clothing. Thus far, the region has weathered well the impact of the elimination of MFA quotas earlier in the year, although this may partly reflect the effect of temporary safeguard measures imposed by the United States on imports from China. Over the longer term, China's rapid growth is expected to put further pressure on Latin America's manufacturing sector, while providing a fillip to growth in agriculture, mining, and services. This underscores the importance of flexible factor markets to facilitate the allocation of resources to fast-growing activities.  D. Global Risks 16. Although the short-term outlook remains generally solid, and the global economy has proved remarkably resistant to the shocks of the last several years, risks to the global outlook are tilted to the downside. (Figure 19) Beyond geopolitical risks, there are four broad-and partly intertwined-concerns: (i) increasing global current account imbalances; (ii) high and volatile oil prices; (iii) shocks to financial market conditions; and (iv) rising protectionist sentiment. Emerging market economies are particularly vulnerable to these risks, since many still harbor vulnerabilities, notwithstanding the progress made in strengthening fiscal and external positions, and making exchange rates more flexible.  17. Global current account imbalances. (Figure 20) The U.S. current account deficit is projected to rise to 6 percent of GDP in 2005, driven by higher oil prices and the continued relative strength of U.S. demand. The key counterparts to this deficit are Japan, China, and oil exporters, including Russia. Resolving these imbalances in an orderly way requires cooperative policies to reduce fiscal deficits in the United States, implement structural reforms to boost domestic demand and growth in the euro area and Japan, and greater exchange rate flexibility and structural reform in Asia. (Figure 21) Progress is being made in these directions, including the improving U.S. fiscal position, steps toward greater exchange rate flexibility in China and Malaysia, and signs of stronger domestic demand in Japan, but more decisive actions are needed to containing the risks of a disorderly adjustment.   18. Oil prices. (Figure 22) High and volatile oil prices remain a significant global risk, especially given the further surge that followed hurricanes Katrina and Rita, and supply constraints given the lack of new investment and limited new capacity coming on stream. Thus, further jumps in oil prices cannot be ruled out, especially in the case of new geopolitical or other shocks. The impact of oil price increases on global growth has so far been surprisingly moderate, reflecting the fact that these increases have been largely driven by strong demand rather than curbs on supply. However, further increases could have a less benign impact, especially if they adversely affect consumer confidence and demand in export markets, increase inflationary expectations, or if they stem from supply-side disruptions. (Figure 23) The risks are particularly acute for EMCs that are net oil importers, especially in those cases where the pass-through has been delayed by fiscal subsidies, since these create the additional risk of a vicious cycle of rising deficits and interest rates-in many cases in an environment of still high debt burdens. Thus, managing the impact of rising oil prices on fiscal balances will be critical.   19. Financial markets. (Figure 24) With global long-term interest rates and risk spreads at unusual lows, there is the potential for financial market conditions to tighten significantly, which would particularly affect countries with large public debt burdens, and also risk eroding credit quality. Especially in view of the rise in world energy prices, a sharp rise in interest rates as a result of a jump in inflationary expectations cannot be ruled out. This illustrates the need for policy makers to safeguard the credibility of their commitments to price stability. Moreover, the unwinding of global current account imbalances could also involve a sharp drop in demand for U.S. financial assets and disorderly movements in interest and exchange rates, which could weigh heavily on activity.1  20. Protectionist sentiment. (Figure 25) We have seen signs that protectionist sentiment and policies are rising, driven by global imbalances and growing fears of emerging market competition. This was especially apparent following the expiration of textile quotas this year and the surge in exports of these products by countries such as China. However, these protectionist policies could exacerbate global risks and further dampen trade and growth, underscoring the need to revitalize the Doha Round.  II. Latin America and Caribbean Region (LAC) A. Recent Developments and Prospects for 2006 21. In the LAC region, growth is moderating after reaching a 24-year high in 2004. (Figure 26) Nonetheless, projected growth rates of about 4 percent in 2005 and 3¾ percent in 2006 are still well above historical averages. Recent growth performance has been supported by the continued strength of global commodity and raw material prices that have boosted terms of trade and exports receipts. Mexico and countries in South America have gained, in particular, from the surge in fuel, food, and metals prices, and have generally been able to exploit these opportunities by expanding volumes-in some cases very substantially. Domestic demand has also generally remained robust (showing renewed strength recently in Brazil), and investment ratios are nearing, on average, a relatively high 20 percent of GDP, although some countries are beginning to face capacity constraints after their strong recoveries (Argentina, Uruguay). (Figure 27) Countries in Central America and the Caribbean have faced a more difficult growth challenge, in part because of pressures exerted by their higher oil import bills. Further efforts to ease investment bottlenecks and attract new private investments will be crucial to easing supply constraints, maintaining domestic demand, and sustaining the momentum for economic growth.   22. Despite the strong increase in world oil prices, inflation in the region has generally stabilized, partly reflecting the prudent stance of monetary policies. (Figure 28) Colombia is a case in point: inflation declined from 6½ percent during 2003 to 5 percent in September 2005-the lowest level in decades; and, in Brazil, the monetary policy tightening of the September 2004-May 2005 period has resulted in a decline in inflation to 6 percent in August on a year-on-year basis, with expectations for end-2005 close to the target of 5.1 percent. Chile and Peru have kept inflation roughly in the 2-3 percent range. Inflation for the region as a whole is projected to ease from 6½ percent in 2005 to 5½ percent in 2006, although Argentina's inflation has reached double-digits, and Venezuela's inflation-although declining-remains in the 17-18 percent range. Moreover, in some countries, real interest rates are still negative, and domestic petroleum prices have generally not increased in line with world market conditions (Box 1).  23. External current account positions are projected to remain strong and external trade should remain supportive. (Figure 29) Strong export volume growth, as well as favorable movements in the terms of trade, have more than offset the surge in import volumes associated with rising domestic demand in 2004. Looking ahead, current accounts are projected to remain in surplus in 2006, despite some projected slowdown in export growth and decline in non-oil commodity prices.  24. A strengthening of policies and improved confidence have been reflected in exchange rate appreciations since mid-2004. For six large countries in the region (Argentina, Brazil, Chile, Colombia, Mexico, and Peru), the nominal effective rate rose by an average of about 9 percent since the beginning of 2005 (based on data through end-July), with a larger increase in Brazil (24 percent), without significantly affecting exports. (Figures 30 and 31) At the same time, reserves have continued to rise; for example, in Argentina, they are approaching US$26 billion, some nine months of imports of goods and services, and in Peru, reserves are more than 270 percent of maturing short-term external debt. (Figure 32) Reserve accumulation in the region reflects current account surpluses and the renewed strength of investor sentiment toward the region, but in some cases the efforts by some countries to resist a rapid appreciation of their exchange rates that they fear could reduce competitiveness. (Figure 33) However, looking ahead, preserving flexibility in exchange rate management-as part of the improved macroeconomic policy mix-will be very important, especially with regard to inflation targets.     B. Resilience of the Current Expansion 25. Prospects seem favorable that the current expansion will be more resilient than in the past, in part because of generally improved macroeconomic policies. (Figure 34) The strengthening of structural fiscal positions in many countries-in contrast to the expansionary policies that led to larger deficits in earlier periods-has been an important step forward. This has also helped contribute to more balanced growth. Economic performance in the current upturn has been driven to an important extent by strong and geographically more diversified exports and by terms of trade gains. Moreover, the current account surpluses that have been achieved during the upswing have significantly reduced the region's dependence on external capital inflows. (Figure 35) This contrasts with earlier episodes, when capital inflows and domestic demand (particularly expansionary fiscal policies) fueled much of the upswing, leading to widening current account deficits and overvalued currencies.   26. The improved framework for monetary policy has also added resiliency to the recovery. (Figure 36) The success of the region's inflation targeting regimes in bringing down inflation, and the willingness of country authorities to address inflationary pressures at an early stage, has bolstered the credibility of monetary policy and contributed to prospects for a more durable recovery. The high level of reserves in many countries also provides a buffer in the event of external shocks.  27. The availability of foreign financing is less likely to become a constraint to growth and stability. (Figure 37) Indeed, stronger trade and fiscal positions have reduced countries' reliance on external borrowing. Near-term vulnerabilities in this context have also been reduced through the prefinancing of future debt service obligations. Many governments in the region have taken advantage of the current benign international financial conditions to prefinance forthcoming debt payments ahead of a full election calendar, and potentially less favorable global market conditions in 2006. By end-June, EMC sovereigns had completed three-quarters of their planned 2005 issuance, and many countries (such as Brazil and Mexico) have begun pre-financing for 2006, and even 2007. Some EMCs have succeeded in lengthening maturities and reducing the proportion of foreign-exchange denominated debt through liability management operations. Brazil conducted a debt exchange to retire most of its outstanding C-bonds (capitalization Brady bonds) for new bonds with a maturity extension of 3.7 years (and plans to buy back the rest in October). Colombia has taken advantage of its strong external position to retire over US$2 billion of its foreign currency debt so far this year. Peru has issued debt in local markets to finance the reduction of its liabilities to the Paris Club, and recent debt exchanges by Argentina and the Dominican Republic have significantly improved the debt profiles of these countries.  28. The increasing role of domestic currency financing in the region also represents a source of resilience. (Figure 38) A number of countries-most notably Brazil, Chile, Colombia, Mexico, and Peru-have increased their reliance on domestic debt issuance, reducing their vulnerability to exchange rate risk and increasing the liquidity of local currency markets. Some countries, including Brazil, Colombia and Uruguay, have also issued global bonds in local currency. The increased use of domestic debt instruments at longer maturities-most prominently in Colombia, Chile, Mexico, and Peru-has also helped improve debt profiles. In some cases, foreign investors have shown strong interest in domestic bond issues (in Mexico, some of the issues at the long end of the curve, at times, have been taken up almost entirely by foreign investors). There are signs that improvements in credit ratings have helped make local-currency debt more attractive for international investors, suggesting that improved fiscal and current account positions have helped keep Latin America's external gross and net issuance of bonds, equities, and loans below the peaks observed in the late 1990s.  C. Risks for the Region 29. Many of the global risks described earlier would also affect Latin America and the Caribbean. I would like to elaborate on four key risks. (Figure 39)  · A sharper-than-expected slowdown in key trading partners or international trade. Despite the success in recent years in diversifying exports, the U.S. market accounted for over 40 percent of the increase in the LAC region's exports between 2002 and 2004. Thus, robust growth in the United States, and continued access to U.S. markets, will be necessary to sustain healthy export performance, especially for countries with strong trade linkages to the United States, such as Mexico. Forthcoming changes in the EU's banana and sugar regimes may have an adverse effect on exports from the Caribbean, but other countries of the region-including Brazil, Costa Rica, and Ecuador-might benefit. For the region as a whole, the risks related to a slowdown in growth in China appear to be low, given its modest share of total exports. Its significant share of world consumption of some key products (such as soybeans and copper), however, could affect selected exporters, including through its impact on prices, which I describe more fully below. · Higher world oil prices and/or a weakening of global commodities markets. (Figure 40) As indicated in Box 1, recent increases in oil prices are not expected to affect the region's growth prospects as a whole, but for some smaller net oil-importing countries, particularly in the Caribbean and Central America, there would be a significant negative growth impact. More generally, however, a continued surge in oil prices, through various mechanisms, could weigh on growth in partner-industrial countries, weaken robust world demand for non-fuel commodities, and lead to a more rapid reduction in their prices than envisaged under the baseline forecast-reversing some of the improvements to the trade balance realized since 2002.   ·Widening risk spreads for emerging market countries would also adversely affect fiscal and external positions in many countries in the LAC region. (Figure 42) The region has benefited significantly from the unusually low level of global interest rates, which has encouraged a "search for yield" and bid down spreads on emerging market debt. Although countries in the region have used this favorable environment to strengthen fiscal positions and debt management, debt-to-GDP ratios in many countries remain very high-generally still above 50 percent of GDP-and there remains a high dependence on exchange-rate linked and short-term instruments. Against this background, the region still remains vulnerable to sudden shifts in global capital market conditions, including those that might be triggered by concerns regarding the large U.S. current account deficit. Given that the larger economies of the region comprise a significant share of emerging market financial instruments, any turbulence for the asset class, as a whole, could have serious consequences for the region.  30. The IMF's September 2005 World Economic Outlook (WEO) provided an illustration of the possible consequences of many of these risks for the global economy. (Figure 43) In particular, the WEO presented simulations of the effects of a combined set of shocks including (i) an abrupt and disorderly adjustment of global current account adjustments; (ii) a rise in protectionist pressures, as well as (iii) a sudden shift in investor sentiment that caused a sharp increase in U.S. interest rates. The effect would be to cause a sharp initial drop in U.S. growth-from around 3½ percent to just over ½ percent in the first year of the shock-and the pace of U.S. activity would remain depressed for several years thereafter. With U.S. demand falling nearly 4 percent below its baseline level, the U.S. dollar depreciating sharply, and global interest rates moving higher, there would be substantial adverse spillovers-including similar output declines for both other industrial countries and developing economies.  · The impact of this type of disorderly adjustment on Latin America and the Caribbean would likely be at least as significant. (Figure 44) High debt levels in the region leave it still very exposed to global interest rate shocks and the historical experience has been that higher U.S. interest rates-especially those stemming from weaker investor sentiment-are magnified by a widening of emerging market spreads. The region would also suffer as a result of a weakening of U.S. import demand given that roughly 60 percent of the region's exports are destined for the United States. Moreover, disorderly adjustments in trade and weaker global growth would also likely cause a reversal of the gains the region has made in its terms of trade, since a diminution of global activity would dampen the prices of metals, grains, and other commodities that have boomed in recent years. Alternative staff simulations suggest that the potential impact could be a sharp drop in real GDP-of over 5 percent of baseline GDP-and a marked deterioration in current account positions.  · The fourth and final risk relates to the political context. (Figure 45) In the next 18 months, 19 countries in the region, including the largest Latin American countries, are slated to have elections, the results of which will affect more than 520 million people. These elections provide an important opportunity to secure mandates for renewed structural reforms and fiscal sustainability efforts. The return of the region to broad macroeconomic stability should facilitate the transitions, and underpin the efforts being made to secure policy continuity and structural change.  D. Policy Challenges 31. While important policy steps have been taken, much more remains to be done. (Figure 46) Going forward, it will be important to build on the foundations for higher sustained growth, not only for reasons of insurance-the strong global commodity prices and demand that have partly underpinned strong export growth may not last-but also to close the gap in growth performance with other dynamic emerging market regions. In particular, real GDP growth in the region has only averaged around 3½ percent since the beginning of the 1980s, and per capita growth has averaged less than 1½ percent. This is considerably weaker than the performance achieved in other dynamic developing and emerging market countries, especially in Asia, and the challenge will be to ensure that the more recent acceleration of growth in Latin America is more than simply another recovery from crisis and instead represents a permanent shift to a higher growth path. Sustained efforts to reduce macroeconomic vulnerabilities will help to achieve this goal, but it will also be necessary to address the fundamental causes of low saving and investment ratios, which while rising in recent years, continue to lag those in other regions.  32. To these end, let me emphasize six key policy priorities in the period ahead: (Figure 47)  · First, continued institutional and policy reforms to reduce public debt. (Figure 48) Buoyant economic activity and the fiscal consolidation efforts of recent years have helped bring debt ratios down significantly throughout the Latin American region (see Box 2). Nevertheless, debt ratios continue to exceed the average of the mid-1990s, and generally remain above levels generally viewed as conducive to growth and broader macroeconomic stability. Debt problems are especially daunting in the Caribbean (Box 3). Sustaining and strengthening fiscal consolidation is therefore a continuing priority, particularly in light of favorable cyclical conditions and the international environment. There is some reason for optimism because of the institutional strengthening that has taken place in many countries in recent years; in this context, fiscal rules and responsibility laws have proven helpful in containing discretionary procyclical spending in a number of Latin American countries, including Brazil, Chile, Colombia, and Peru. For oil exporters such as Ecuador, Mexico, and Venezuela, today's high prices provide an exceptional opportunity to further reduce public debt. Further efforts to curb non-essential expenditures, broaden and boost revenues, and improve budget flexibility could also spur growth by helping to reduce debt burdens and make room for increased spending on productivity-enhancing and poverty-reducing physical and social infrastructure.  · A second policy challenge is to maintain low inflation. (Figure 49) Notwithstanding the remarkable progress in reducing inflation in the region, there remains scope to further entrench these gains. For example, sustaining the credibility of inflation-targeting frameworks, which have helped to anchor inflation expectations in a number of large Latin American countries, will be important in containing inflationary pressures. Further steps to enhance central bank independence and policy transparency would be helpful in this regard.  33. In addition to macroeconomic policies that promote stability, a well-coordinated strategy to reduce structural impediments to private savings, investment, and innovation is also needed. In particular, further progress is needed in the following areas: · Financial sector reforms need to be accelerated. (Figure 50) LAC still lags behind other regions in financial intermediation and credit availability. Real interest rates remain high in many countries, reflecting, inter alia, inefficiencies in the banking system (Box 4). Countries in the region will need to continue to give priority to strengthening financial system regulation, building consolidated supervision, bringing financial institutions up to international prudential standards, and upgrading bankruptcy laws. The continued development of local currency capital markets (including the deepening of local government and corporate bond markets, equity markets, and the introduction of derivative products, where appropriate) to manage interest rate and exchange rate risk would also help improve the efficiency of financial intermediation. A strengthening of financial sectors would also help reduce the high level of dollarization that still characterizes some of the countries of the region. (Figure 51) As indicated by the recent experience of Peru, for example, the combination of good macroeconomic policies and improved financial sector regulation can successfully reduce dollarization.   · Greater trade openness and foreign direct investment need to be fostered. (Figure 52) Notwithstanding recent gains, Latin America is still relatively closed to international trade compared with other dynamic regions. Indeed, it is worrisome that LAC exports are projected to fall as a share of GDP, even as other regions are expected to further deepen their integration into international markets. Recent trade initiatives-including the CAFTA-DR-may help on this front (see Box 5), and a successful and ambitious conclusion to the Doha Round also could provide a significant boost to the region. Key areas of particular importance to the LAC region include the phasing out export subsidies and market access for agricultural imports; tariff reductions on other goods by middle-income countries; and the treatment of services.  · Efficiently managing and using natural resources: (Figure 53) Despite having the largest proven oil reserves in the world after the Middle East, the region has been unable to increase production to take full advantage of the boom in oil prices. The sluggish trend in output reflects short-term factors-sporadic work stoppages-as well as deeper, underlying constraints that have inhibited necessary investments. Among the latter have been weak public finances, the dominant position of national oil companies with generally weak governance, and an unpredictable policy environment that has discouraged private-sector investment. A stronger national consensus is needed in many countries on improving the climate for new investment in these sectors, as well as on ensuring that the benefits are more equitably shared in strengthening employment and output in domestic non-oil sectors while also reducing debt vulnerabilities.  · More generally, business climates need to be improved to encourage private investment, (Figure 54) particularly by strengthening the rule of law and the enforcement of contracts, improving regulatory frameworks, and by strengthening competition policy. (Figure 55) Governance also needs to be improved. Despite some progress in the late 1990s, governance indicators for the LAC region have deteriorated in recent years and improvements on this front will be necessary to support sustained and strong growth. Similarly, policies aimed at removing costly distortions, including through labor market reforms, would help improve the investment climate and create a firmer foundation for economic activity.   34. A strengthening of policies could help jumpstart a virtuous circle of higher growth and poverty reduction. (Figure 56) Higher growth would benefit the poor, including through its positive effects on health and educational attainment. This, together with a reallocation of public expenditure to well-targeted and efficient social sector programs, could help bolster labor productivity and further raise the earnings of the poor, which would further solidify the social consensus in favor of growth-enhancing policies.  E. The Role of the Fund in Latin America and the Caribbean 35. Favorable global conditions and economic performance have reduced the need for the Fund's direct financial support to the region over the past two years. (Figure 57) After the IMF-led support packages of 2002-03 that were assembled quickly to address the crisis situations faced in many countries, the region quickly stabilized and returned to growth, with output in the most affected countries now well above the pre-crisis levels. Thus, purchases from the Fund by countries in the region fell to low levels in  36. In response-including in the context of the Fund's new medium-term strategy-the Fund's involvement in the region has broadened and taken on new dimensions. In different ways tailored to individual circumstances, Fund arrangements have helped maintain macroeconomic stability and continuity during periods of political change. Disbursements have been made to provide assistance after national disasters (Grenada) and to support post-conflict recovery (Haiti). In many other cases, countries without formal arrangements have sought a close dialogue with the Fund on economic policies that goes well beyond annual Article IV consultations. This includes countries such as Ecuador and Jamaica, which have requested regular assessments of economic and policy developments to provide input to other lenders' and donors' decisions on financial assistance. The nature of the Fund's surveillance has also changed, with greater emphasis on crisis prevention. This is manifested, for example, in the increased attention being paid to the financial sector, including through the Financial Sector Assessment Programs undertaken in partnership with the World Bank. Thus far, 20 countries in the region have participated in this program. We have also been strengthening our technical assistance in the Caribbean through the operations of the Caribbean Technical Assistance Center (CARTAC), which serves 20 countries. In sum, Fund involvement in the region will continue to evolve, in light of the needs of our member countries. Main Economic Indicators September 2005 WEO Projections

References Chai, J., and R. Goyal, 2005, "Tax Concessions and Foreign Direct Investment in the ECCU," IMF Country Report No. 05/305, Chapter V (Washington, D.C.: International Monetary Fund). Duttagupta, R., and G. Tolosa, 2005, "Fiscal Policy in a Regional Currency Union," IMF Country Report No. 05/305, Chapter IV (Washington, D.C.: International Monetary Fund). Karsulu, M., 2005, "Competition in the Chilean Banking Sector: A Cross-Country Comparison," in Chile: Selected Economic Issues, SM/05/271, Chapter III. Levine, R., 2004, "Finance and Growth: Theory and Evidence," NBER Working Paper 10766. Rodlauer, M., and A. Schipke, 2005, Central America: Global Integration and Regional Cooperation, IMF Occasional Paper 243. Sahay, R., 2005, "Stabilization, Debt, and Fiscal Policy in the Caribbean," IMF Working Paper No. 05/26 (Washington: International Monetary Fund). World Bank, 2005a, DR-CAFTA: Challenges and Opportunities for Central America (Washington, D.C.: The World Bank). World Bank, 2005b, "Towards a New Agenda for Growth: Organization of the Eastern Caribbean States" (Washington, D.C.: The World Bank). Singh, A., and A. Belaish, C. Collyns, P. De Masi, R. Krieger, G. Meredith, and R. Rennhack, Stabilization and Reform in Latin America: A Macroeconomic Perspective on the Experience Since the Early 1990s, IMF Occasional Paper 238. 1 See Appendix 1.2 of the September 2005 World Economic Outlook. |

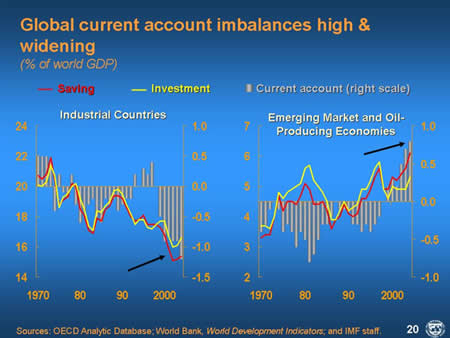

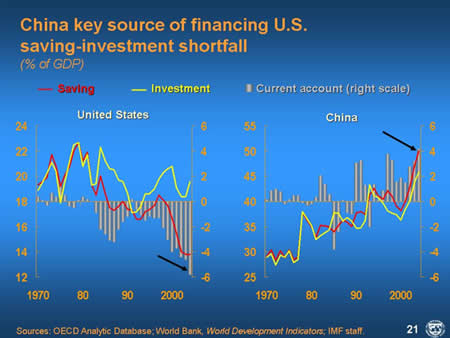

IMF EXTERNAL RELATIONS DEPARTMENT

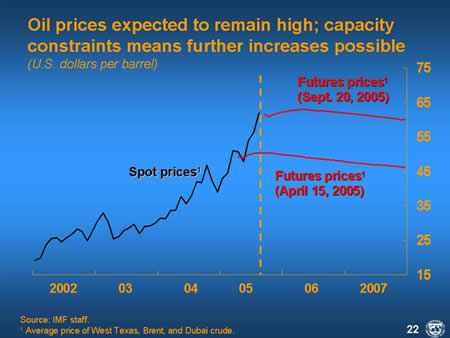

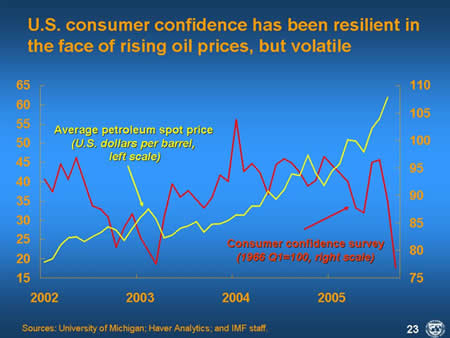

| Public Affairs | Media Relations | |||

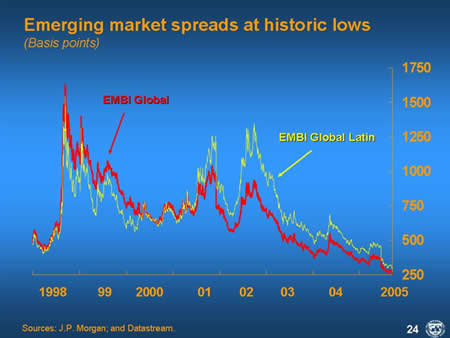

|---|---|---|---|---|

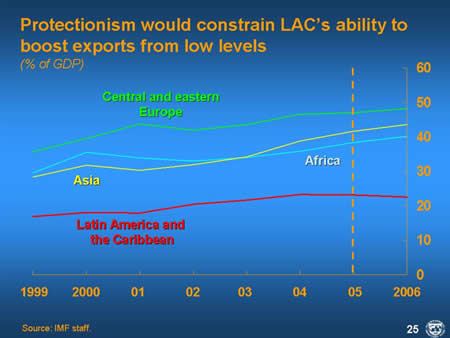

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

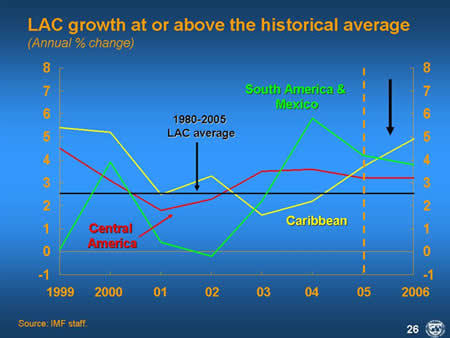

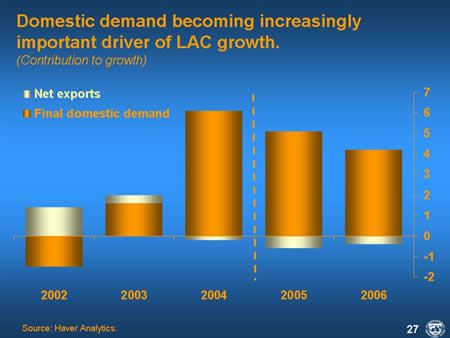

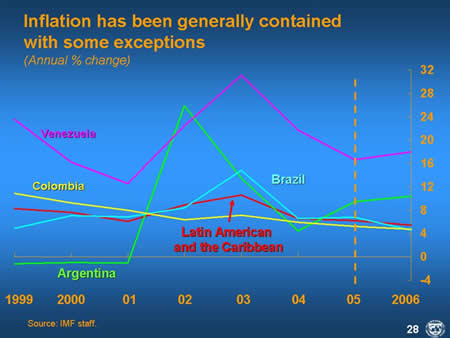

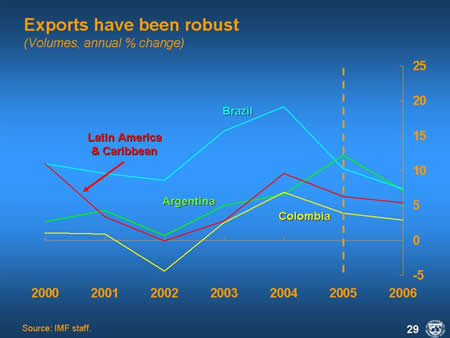

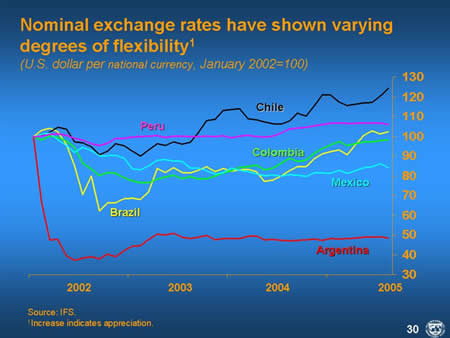

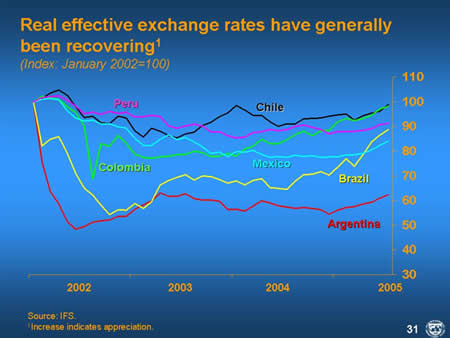

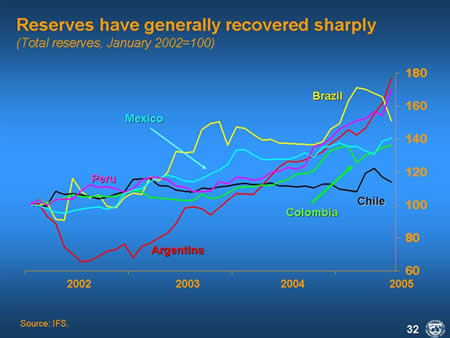

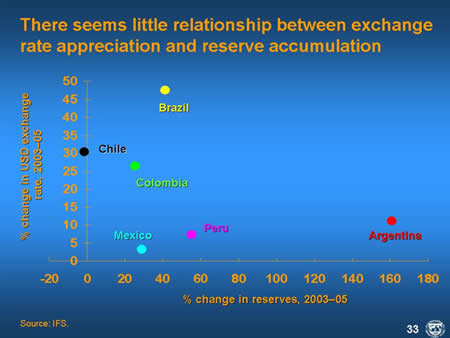

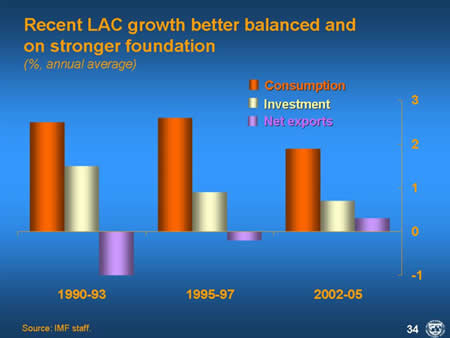

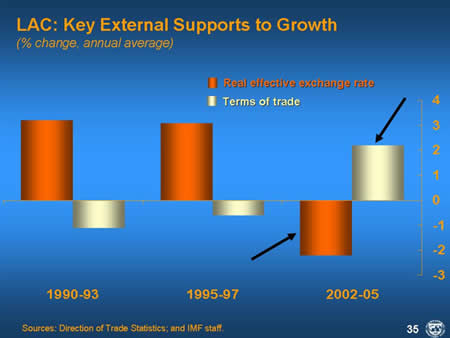

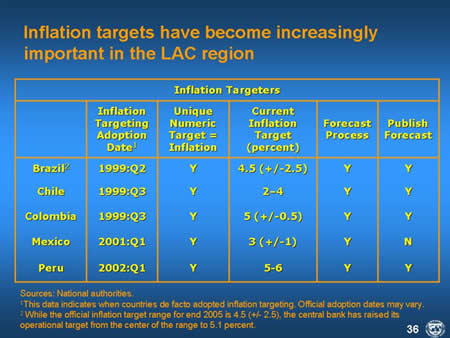

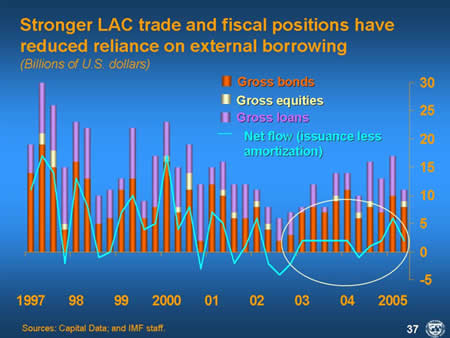

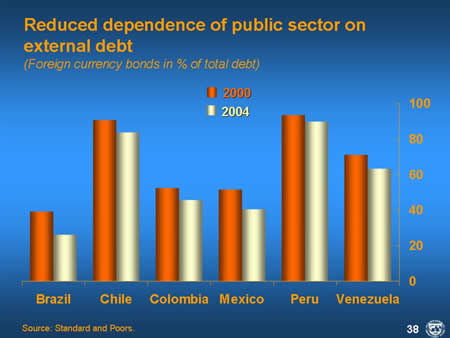

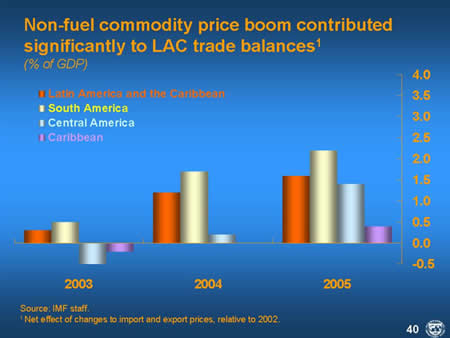

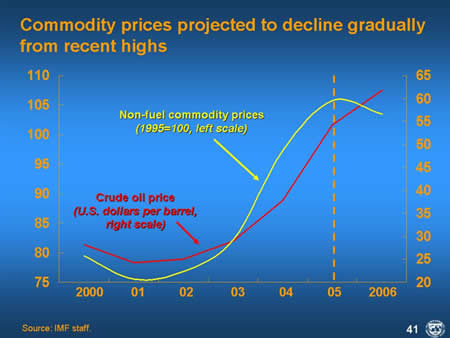

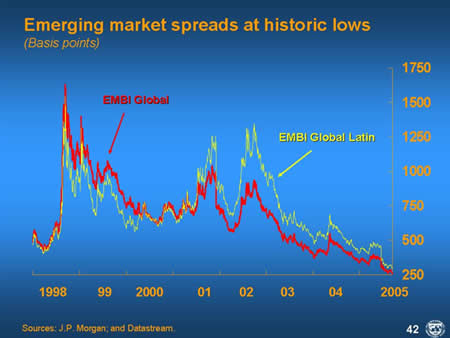

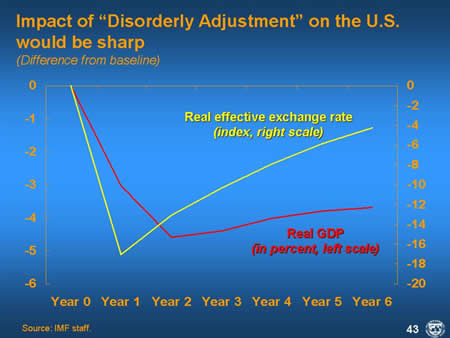

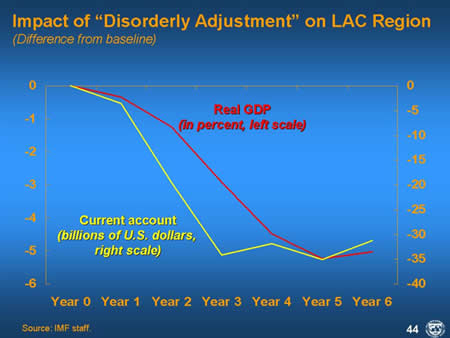

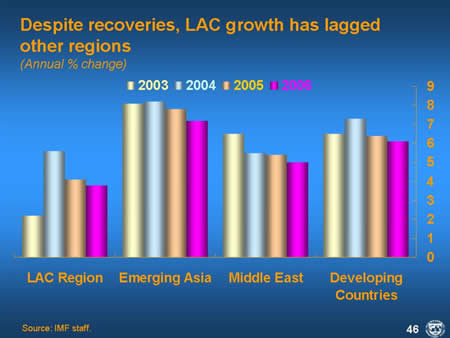

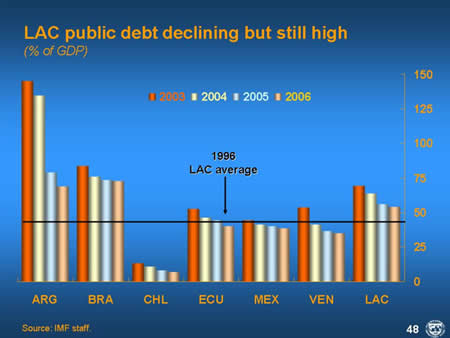

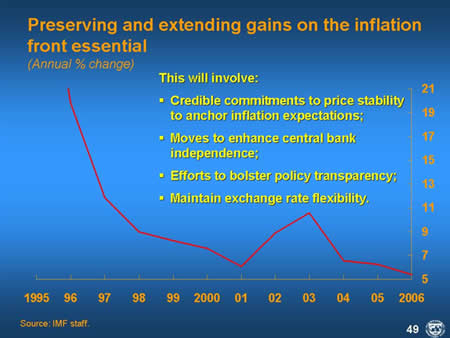

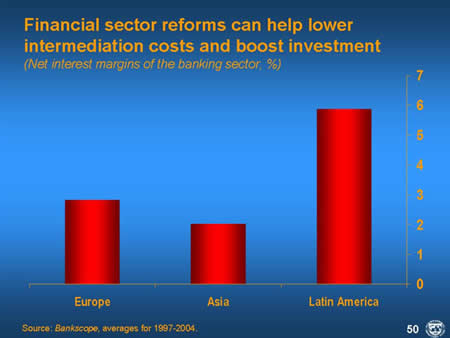

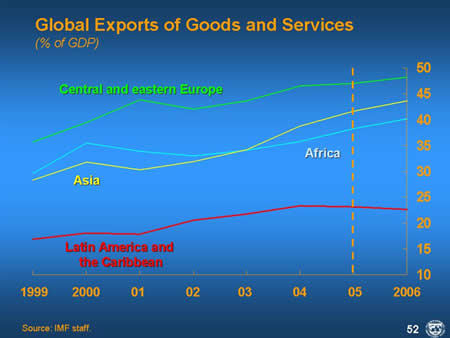

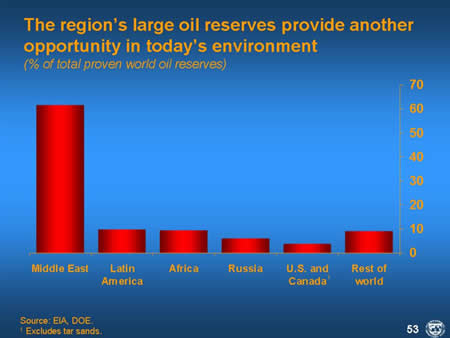

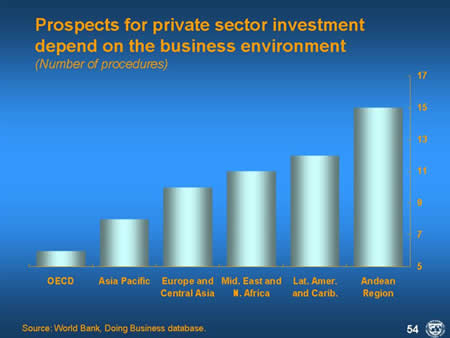

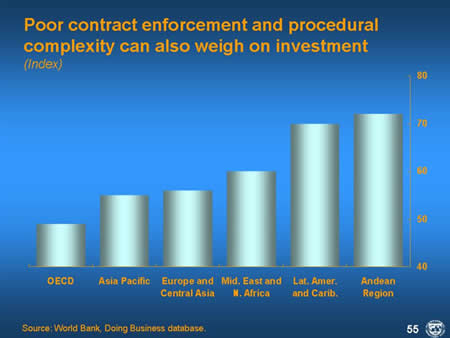

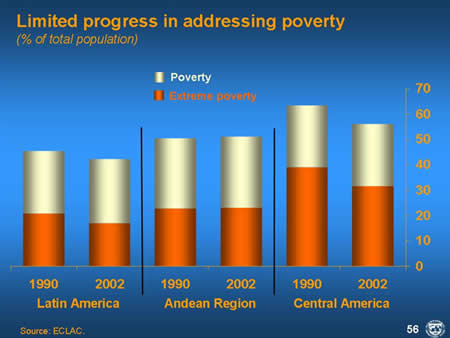

| Fax: | 202-623-6278 | Phone: | 202-623-7100 | |