Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Plain Vanilla Investment Funds Can Pose Risks

April 8, 2015

- Asset management industry plays rising role in financial system

- Role has benefits, risks for financial stability

- More “hands on” supervision needed, with better data, oversight

Even simple investment funds such as mutual funds can pose financial stability risks, and regulators need to know more about them through hands-on supervision, and better data and oversight, according to new research from the International Monetary Fund.

An investor in Seoul: even simple investments like mutual funds can pose risks to financial stability (photo: Reuters/Jo Yong-Hak)

Global Financial Stability Report

Asset management firms help investors diversify their assets easily. The industry can also be a “spare tire” for financing the real economy when banks are distressed. Compared to banks, investment funds offered by asset managers are less likely to default because end investors bear losses and gains from the funds’ assets.

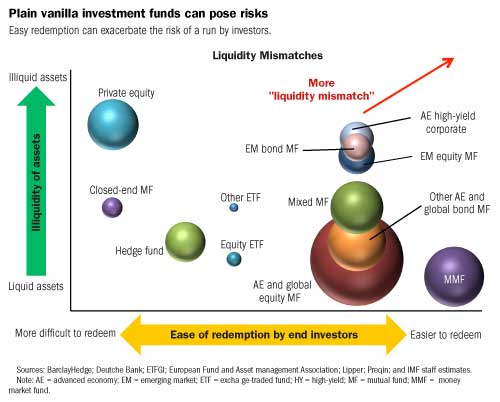

In the latest research for the Global Financial Stability Report, the IMF said the debate about possible risks related to the industry had intensified. Risks from some segments of the industry—leveraged hedge funds and money market funds—are already widely recognized. However, there is an ongoing discussion about the risks from less leveraged, “plain-vanilla” investment products, such as simple mutual funds and exchange-traded funds investing in bonds and equities.

“The new attention to possible risks related to asset management is motivated by the growth of the industry, its larger focus on less liquid bonds, and by concerns that in some advanced economies, many funds have increasingly been buying similar assets, while banks have withdrawn from market making,” said Gaston Gelos, Chief of the Global Financial Stability Analysis Division at the IMF.

Size and scope

The industry manages over $75 trillion assets globally, exceeding 100 percent of world GDP, the IMF said. In particular, bond funds have grown significantly, investing in less-liquid assets such as emerging market bonds and high-yield corporate bonds. This has increased the mismatch between the liquidity of funds’ assets and liabilities, because many funds allow investors to redeem on a daily basis.

Large redemptions from these funds – possibly triggered by an external event, such as a faster-than-anticipated rise in interest rates in the United States - may have a widespread market impact, especially if banks are unable or unwilling to step in to provide liquidity in such a situation.

In its latest Global Financial Stability Report, the IMF provides a detailed analysis of various risk-creating features of the industry and suggests how to revamp oversight of the sector.

Understanding the risks

The analysis highlights that it is important to distinguish conceptually risks that are introduced by the presence of funds from those that would exist even in their absence; that is if investors bought securities directly. The IMF’s main conclusions are:

First, mutual fund investments affect asset prices, at least in less-liquid markets, such as emerging market bonds. Mutual fund flows drive price movements in these markets. Prices of assets that are held in a concentrated manner by funds drop more sharply during periods of market nervousness.

Second, easy redemption options offered by funds can exacerbate the risk of a run by investors wanting their money all at once, compared to a situation in which investors hold assets directly. Some funds have asset-valuation and share-pricing practices that provide a “first-mover” advantage to investors—investors redeeming earlier than others can recover more money. To some extent, this risk is mitigated by the fact that “riskier” funds—those investing in illiquid assets and more vulnerable to runs—protect themselves by holding more liquid assets and charging higher redemption fees. And redemption fees are indeed effective in mitigating redemption pressures during stress periods.

Third, the delegation of day-to-day portfolio management introduces incentive problems between end investors and portfolio managers. As a result, asset managers may engage in herding—trading in the same direction as their peers. Measures of herding behavior have risen in the past few years, possibly because of a generalized search for yield in a low-interest environment that drove these funds to invest in similar assets.

Fourth, unlike banks, larger funds and funds belonging to larger asset management companies do not necessarily contribute more to systemic risk. Rather, the nature of the assets they invest in appears to be relatively more important than size. This is an important factor to consider when trying to find the best ways to identify systemically important asset managers or products; an issue that regulators from around the world are discussing actively.

More “big picture” supervision

The evidence calls for a better supervision of institution-level risks. Currently, the oversight of the industry focuses on investor protection and disclosure, and regulators conduct little monitoring in most countries. Securities regulators should shift to a more hands-on supervisory approach with better data, risk indicators, and analysis, including stress testing, according to the IMF. Establishing global standards on how to monitor and supervise the industry is essential.

Policymakers and regulators should adopt a macroprudential approach to assess the impact of the industry as a whole on the stability of the financial system. In this context, supervisors and regulators need to re-assess the role and adequacy of existing risk management tools.

“In particular, regulators should find ways to reduce the incentive for investors to withdraw their money when they see others exiting,” said Gelos. “This could be done, for example, by well-designed redemption fees that do not hurt investors overall, for example if the revenue accrues to the fund’s net asset value. Moreover, the pricing of fund shares should be set in such a way that exiting investors do not pass on the cost of liquidity to remaining ones.”

The IMF will release further work from the Global Financial Stability Report on April 15.