Russia: Staff Concluding Statement of the 2019 Article IV Mission

May 24, 2019

An International Monetary Fund (IMF) staff team, led by Mr. James Roaf, visited Moscow during May 14-24 to conduct the 2019 Article IV Consultation discussions.

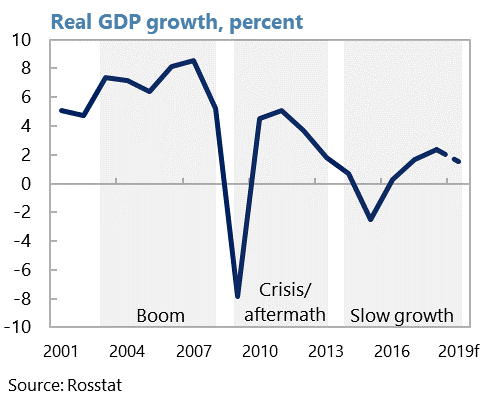

Russia’s growth prospects will depend on the strength of domestic policies and reforms. GDP growth in the past three years averaged 1.4 percent and is projected at a similar rate in 2019. External support is expected to be limited, as sanctions, global political and trade uncertainty and lower oil prices have replaced the favorable external conditions that contributed to rapid growth in the 2000s boom. Thus Russia now needs to focus on domestic reforms to improve growth potential. A key building block is the credible macroeconomic framework the authorities have established since 2014, in difficult circumstances, in the form of inflation targeting, exchange rate flexibility and the fiscal rule. These have helped weather external shocks and reduce uncertainty about the domestic environment. Improvements in financial sector soundness put banks in a better position to support growth. And the 2018 pension reform will help offset the negative demographic trend in labor markets. Beyond these factors, stronger medium-term growth will require an acceleration of structural reforms to improve the working of the economy. The National Projects announced in 2018 have potential to reinvigorate activity, but only if they are implemented effectively and complemented with far-reaching efforts to strengthen competition, roll back the state and improve state-owned enterprise efficiency.

Maintain strong macroeconomic and financial policy frameworks

The fiscal rule anchors the budget framework and shields the economy from oil price fluctuations. Further changes to the rule, especially after the slight relaxation last year, should be avoided, in order to firmly establish its credibility. The authorities should refrain from quasi-fiscal activities through the National Welfare Fund (NWF) and should continue to invest NWF funds into high-quality foreign assets (even after the liquid part of the fund reaches the 7 percent of GDP threshold), to safeguard resources for future generations and avoid procyclicality.

Monetary policy has been successful in addressing potential shocks to price stability, and easing now appears appropriate. The monetary policy stance is estimated to be moderately tight. The VAT increase has had a lower-than-expected impact on headline inflation, and the recent slight appreciation of the ruble and stability of domestic fuel prices reduce inflationary pressures. A forecast that incorporates these developments is consistent with inflation reaching the 4 percent target in early 2020, under a declining path for the central bank’s policy rate. Delay in reducing rates would increase the likelihood of subsequently undershooting the inflation target next year.

Further bolstering financial sector soundness will help support economic growth. The cleanup of the banking sector needs to be completed. At the same time, the authorities need to continue strengthening bank supervision and regulation. This should include reducing lending concentration and related-party loans; strengthening the ongoing process of asset quality review analysis; and fully implementing Basel III regulatory standards as scheduled. Additional measures to curb unsecured consumer lending may be needed to contain financial stability risks if current measures prove inadequate. The authorities also need to develop a strategy for returning rehabilitated banks to private hands in a way consistent with increasing competition among banks.

Increase government effectiveness to support growth

The potential to raise growth will depend on the ambition of reforms to strengthen competition and reduce the role of the state. Combined with the labor supply impact of pension reform, the public infrastructure spending quantified under the National Projects is projected to lift potential growth by 0.1-0.5 percentage points, depending on the effectiveness with which projects are identified, planned and implemented. Other welcome initiatives under the projects include targeting demographics, labor productivity and employment support, SMEs and entrepreneurship support, enhancing international cooperation, and increasing non-commodity exports. However, more specifics would be needed to assess their potential effects. To achieve significant growth dividends, reforms will need to address the long-standing problems of lack of competition in the economy, and relatedly, the large footprint of the state – both in terms of its high share in the economy and its intrusiveness into business activity. This should involve facilitating the entry and exit of firms; strengthening SOE governance; fully implementing plans for improving the business climate; and encouraging competition within and across regions, including in public procurement.

The authorities’ plans for a growth-friendly shift in taxes and spending are welcome but could be extended, within the confines of the fiscal rule. Along with the planned increase in public investment, additional spending on health and education under the national projects is welcome provided it is well-targeted to further improve Russia’s relatively strong human capital. Oil sector taxation should be simplified and made more transparent, including phasing out subsidies for domestic consumption while ensuring protection for vulnerable groups that could be affected. Improved revenue collection and removal of inefficient tax breaks could finance a reduction in social contributions, helping address informality. Notwithstanding the recent pension reform, early retirement provisions remain overly generous. Social benefits could be better targeted toward reducing poverty by shifting from universal to means-tested benefits.

Russia has made significant progress since being one of the first countries to volunteer for an IMF Fiscal Transparency Evaluation in 2014. Budgetary openness is strongly associated with better public sector efficiency, lower borrowing costs, and reduced vulnerability to corruption. Over the last five years, the government has built on its relatively good record in this area by providing estimates of the value of its natural resources, reporting in detail on the cost of tax expenditures, publishing a comprehensive fiscal risks report and longer-term fiscal projections, and adopting a program-based budget classification. However, further progress is needed, including to report the government’s obligations under PPPs, to reduce the share of classified expenditure in the budget – projected to rise to 20 percent in 2021 – and to strengthen governance and enhance the financial reporting of the over 30,000 state-owned enterprises.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Gediminas Vilkas

Phone: +1 202 623-7100Email: MEDIA@IMF.org