(Kuwait City Skyline / photo: iStock)

Why Improving Fiscal Institutions is Critical to the Middle East and Central Asia

October 28, 2019

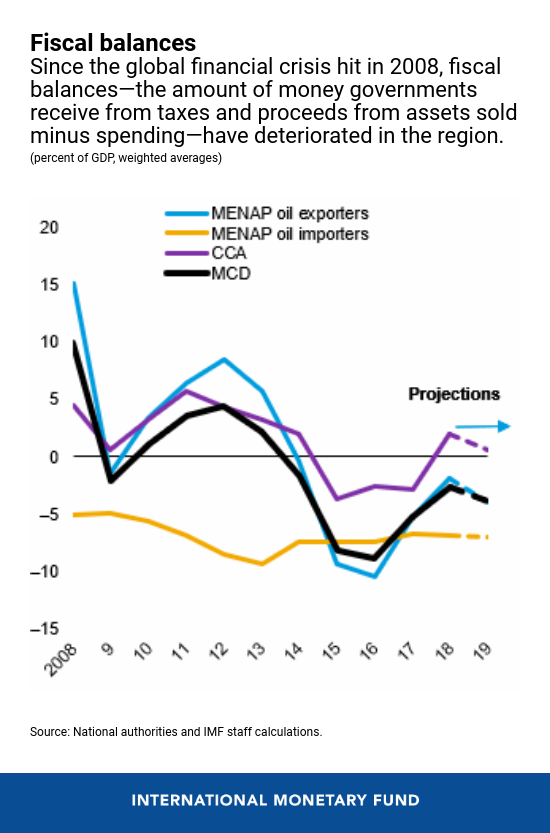

In the decade since the global financial crisis, countries in the Middle East and Central Asia have grappled with rising deficits and debt, with overall fiscal balances for the region turning from a surplus of about 10 percent of GDP in 2008 to consistently negative in recent years. Fiscal challenges have also arisen in the context of underdeveloped and ineffective fiscal institutions. The latest Regional Economic Outlook explores how these institutions relate to fiscal outcomes.

Several factors have contributed to this precarious outcome, including low growth, oil price shocks, and rising spending needs, including in countries affected by the Arab uprisings.

“By improving the transparency and accountability of their fiscal institutions, countries in the region can help reduce their fiscal vulnerabilities, promote sustainable policies, enhance the efficiency of public spending, and, in general, strengthen their economies,” said Jihad Azour, director of the IMF’s Middle East and Central Asia Department.

How Do Fiscal Institutions in the Middle East and Central Asia Measure Up?

Related Links

Fiscal institutions, when effectively developed and implemented, help strengthen fiscal discipline, build resilience, reduce spending volatility, and significantly improve fiscal health—all things that reduce economic vulnerabilities for countries over time.

There are several metrics for assessing the effectiveness of fiscal institutions, such as how much budget information is made publicly available and whether governments have mechanisms in place to develop and implement medium-term budget goals.

There are some bright spots in the region. For instance, oil importers in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region and countries in the Caucasus and Central Asia (CCA) have shown notable progress in budget transparency in recent years, though their overall scores remain relatively low. However, countries in the two regions do not compare favorably to peers on a number of factors. Consider the following findings:

- MENAP’s oil exporters have significantly lower levels of budget transparency compared to other oil-exporting countries. In fact, Algeria, Iraq, and Qatar registered no improvement between 2012 and 2017, whereas other oil-exporting countries—when Venezuela is excluded—improved by 5 percent on average. There are some encouraging cases, however: Saudi Arabia has made significant efforts to improve transparency since 2017, including through the publication of more comprehensive budget statements and audited financial statements.

- Many countries in the region, and particularly those in the CCA, fare poorly on public procurement.

- More than half of MENAP’s oil-importing countries do not have a mechanism for setting fiscal goals with strategies to achieve them over a multiyear period.

The overarching takeaway from the IMF’s analysis is clear: MENAP and CCA countries have significant room for improvement in strengthening their fiscal institutions.

Charting a More Sustainable Path Forward

Strengthening fiscal institutions would enable MENAP’s oil exporters to better insulate their economies from global oil price volatility, help oil importers in their efforts to reduce high levels of public debt, and better position CCA countries to reduce vulnerabilities to future shocks. To illustrate just one potential outcome: It is estimated that public debt accumulation could be slowed by more than 4 percent of GDP over the medium term compared to current levels if countries adopted best practices on several key attributes of effective fiscal institutions.

How can this be done? Countries with low transparency scores should take measures to open their budget processes and provide more data on projections and risks. Tunisia and Uzbekistan, with IMF technical assistance, have taken important steps forward on this front by implementing a fiscal transparency evaluation system—an effort that could be a model for other countries as they consider reforms.

Establishing medium-term budgetary goals and strategies can enhance fiscal discipline and help reduce the pace of debt accumulation. Strengthened public financial management systems and procurement processes are also needed. Kuwait offers an encouraging example with a new law aimed at promoting competition and transparency in procurement. Its full implementation will introduce modern approaches to bid evaluation and encourage greater participation by small and medium-sized enterprises.

There is no one-size-fits-all approach for countries as they consider ways to bolster fiscal institutions and tackle fiscal challenges, and there are other important aspects of this issue that governments should not lose sight of. However, by recognizing that the quality of fiscal institutions is inextricably linked to the success, or failure, of fiscal policy, policymakers can make important strides as they work to make their countries more resilient and prosperous in the years ahead.