Near-term risks to global financial stability have receded as disinflation is entering its last mile but medium-term vulnerabilities are mounting.

Chapter 1 documents that near-term global financial stability risks have receded amid expectations that global disinflation is entering its last mile. However, along it, there are several salient risks and a build-up of medium-term vulnerabilities.

Chapter 2 assesses vulnerabilities and potential risks to financial stability in corporate private credit, a rapidly growing asset class—traditionally focused on providing loans to midsize firms outside the realms of either commercial banks or public debt markets—that now rivals other major credit markets in size.

Chapter 3 shows that while cyber incidents have thus far not been systemic, the probability of severe cyber incidents has increased, posing an acute threat to macrofinancial stability.

Chapter 1: Financial Fragilities along the Last Mile of Disinflation

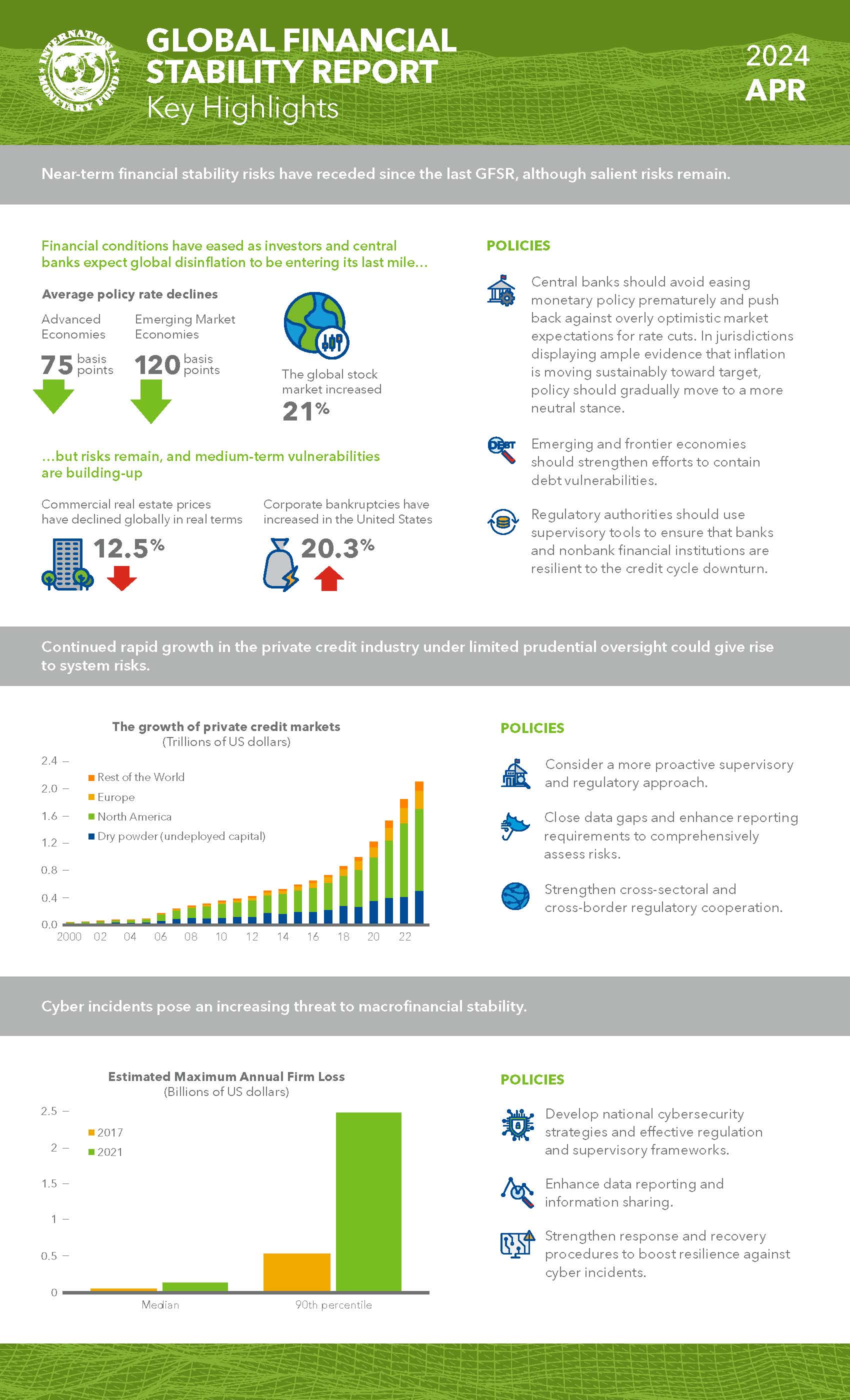

Expectations that global disinflation is entering its “last mile” and monetary policy will be easing have eased financial conditions worldwide since the October 2023 Global Financial Stability Report. Emerging markets have shown resilience, and some frontier economies have issued international debt. The global economy appears increasingly likely to achieve a soft landing, and cracks in the financial system exposed by high interest rates have not ruptured further. Near-term global financial stability risks have receded. However, there are several salient risks along the last mile. Growing strains in the commercial real estate sector and signs of credit deterioration among corporates could be exacerbated by adverse shocks. Stalling disinflation could surprise investors, leading to a repricing of assets and a resurgence of financial market volatility. Beyond these more immediate concerns, other medium-term vulnerabilities are building, notably the continued accumulation of debt in both public and private sectors.

Chapter 2: The Rise and Risks of Private Credit

Chapter 2 assesses vulnerabilities and potential risks to financial stability in private credit, a rapidly growing asset class—traditionally focused on providing loans to mid-sized firms outside the realms of either commercial banks or public debt markets—that now rivals other major credit markets in size. The chapter identifies important vulnerabilities arising from relatively fragile borrowers, a growing share of semi-liquid investment vehicles, multiple layers of leverage, stale and potentially subjective valuations, and unclear connections between participants. If private credit remains opaque and continues to grow exponentially under limited prudential oversight, these vulnerabilities could become systemic.

Given the potential risks posed by this fast-growing and interconnected asset class, authorities could consider a more proactive supervisory and regulatory approach to private credit. It is key to close data gaps and enhance reporting requirements to comprehensively assess risks. Authorities should closely monitor and address liquidity and conduct risks in funds—especially retail—that may be faced with higher redemption risks.

Chapter 3: Cyber Risk: A Growing Concern for Macrofinancial Stability

Against a backdrop of growing digitalization, evolving technologies, and rising geopolitical tensions, cyber risks are on the rise. Chapter 3 shows that while cyber incidents have thus far not been systemic, the risk of extreme losses from such incidents has increased. The financial sector is highly exposed, and a severe cyber incident could pose macro-financial stability risks through a loss of confidence, disruption of critical services, and spillovers to other institutions through technological and financial linkages. While better cyber legislation and cyber-related governance arrangements at firms can help mitigate these risks, cyber policy frameworks remain generally inadequate, especially in emerging market and developing economies. Thus, the cyber resilience of the financial sector needs to be strengthened by developing adequate national cybersecurity strategies, appropriate regulatory and supervisory frameworks, a capable cybersecurity workforce, and domestic and international information-sharing arrangements. To allow for more effective monitoring of cyber risks, reporting of cyber incidents should be strengthened. Supervisors should hold board members responsible for managing the cybersecurity of financial firms and promoting a conducive risk culture, cyber hygiene, and cyber training and awareness. To limit potential disruptions, financial firms should develop and test response and recovery procedures. National authorities should develop effective response protocols and crisis management frameworks.

Publications

-

March 2024

Finance & Development

-

ECONOMICS

How should it change?

-

September 2023

Annual Report

- COMMITTED TO COLLABORATION

-

Regional Economic Outlooks

- Latest Issues