Research Projects

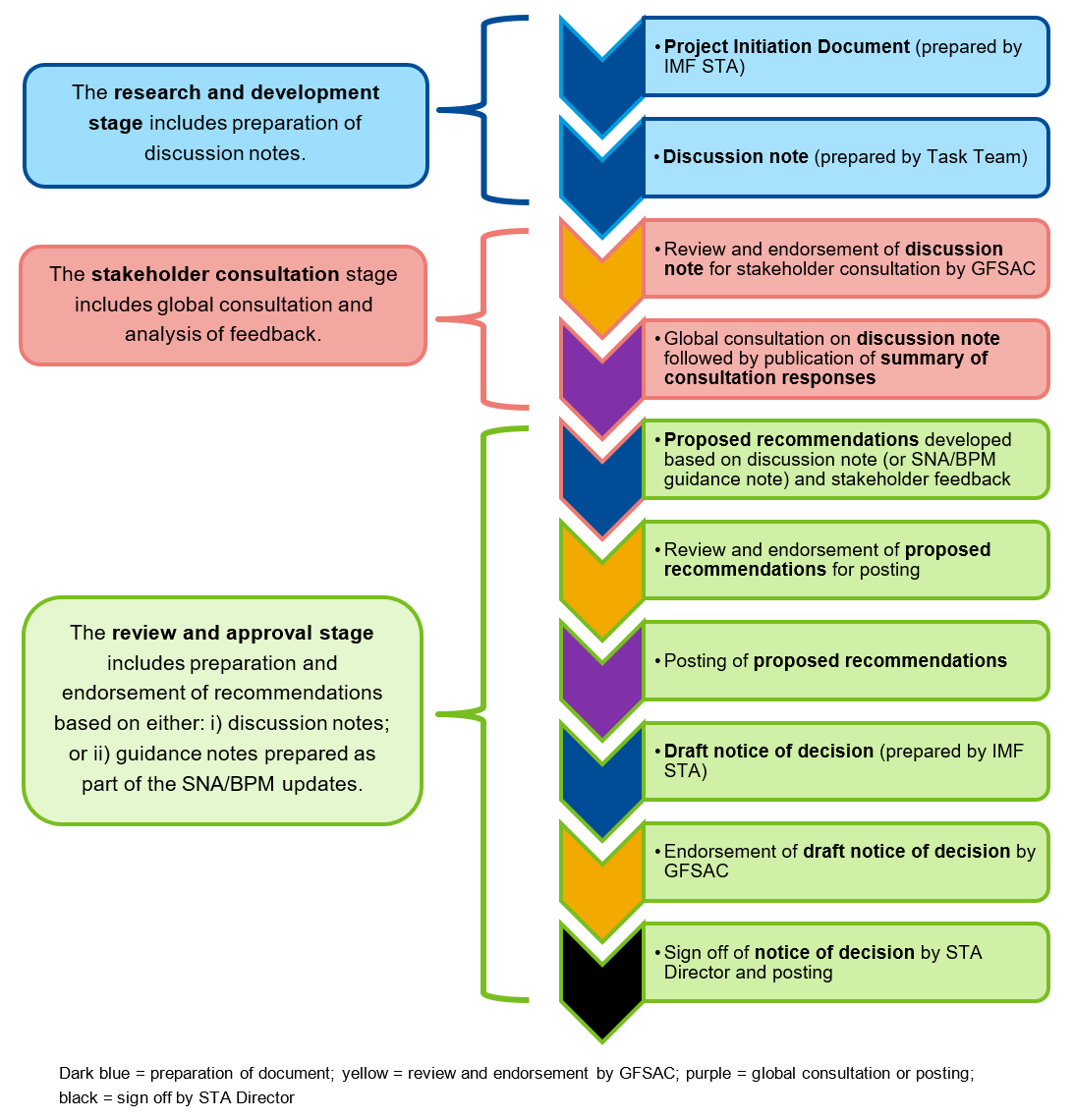

The research projects being pursued under the GFS Manual Update include those related to SNA/BPM recommendations and GFS-specific issues. As described in the Process and Timeline for Updating the GFSM 2014, the development of research projects includes preparation of discussion notes and proposed recommendations, with final decisions reflected in notices of decision. All such documents can be accessed by research project below, with current and previous consultations on research projects accessible on the Global Consultations webpage.

| Title | Discussion Notes | Proposed Recommendations | Notices of Decision |

| SNA/BPM-related research projects | |||

| 1.1 Valuation principles and methodologies | N/A | Download PDF | Download PDF |

| 1.2 Treatment of rent | N/A | Download PDF | Download PDF |

| 1.3 Treatment of centralized currency unions in macroeconomic statistics | N/A | Download PDF | Download PDF |

| 1.4 Recording citizenship-by- investment (CBI) programs | N/A | Download PDF | Download PDF |

| 1.5 Treatment of external assets and related income declared under tax amnesty | N/A | Download PDF | Download PDF |

| 1.6 Financial and operating leases | N/A | Download PDF | Download PDF |

| 1.7 Recording penalties and fines | N/A | Download PDF | Download PDF |

| 1.8 Valuation of unlisted equity | N/A | Download PDF | Download PDF |

| 1.9 Improving the recording of government-controlled nonresident SPEs | N/A | Download PDF | Download PDF |

| 1.10 Identifying superdividends and establishing the borderline between dividends and withdrawal of equity | N/A | Download PDF | Download PDF |

| 1.11 Identifying, valuing and reporting government data assets | N/A | Download PDF | Download PDF |

| 1.12 Reverse transactions | N/A | Download PDF | Download PDF |

| 1.13 Financial derivatives by type | N/A | Download PDF | Download PDF |

| 1.14 Capturing non-bank financial intermediation | N/A | Download PDF | Download PDF |

| 1.15 Treatment of cash collateral | N/A | Download PDF | Download PDF |

| 1.16 Treatment of factoring transactions | N/A | Download PDF | Download PDF |

| 1.17 Debt concessionality | N/A | Download PDF | Download PDF |

| 1.18 The recording of crypto assets in macroeconomic statistics | N/A | Download PDF | Download PDF |

| 1.19 Treatment of special purpose entities (SPEs) and residency | N/A | Download PDF | Download PDF |

| 1.20 Payments for nonproduced knowledge-based capital (marketing assets) | N/A | Download PDF | Download PDF |

| 1.21 Islamic finance | N/A | Download PDF | Download PDF |

| 1.22 Treatment of Emissions Trading Schemes | N/A | Download PDF | Download PDF |

| 1.23 Environmental classifications within GFS | N/A | Download PDF | Download PDF |

| 1.24 Distinction between taxes, services and other flows | N/A | Download PDF | Download PDF |

| 1.25 Relationship between SNA and IPSAS/IAS | N/A | Download PDF | Download PDF |

| 1.26 Treatment of trusts and other types of funds as separate institutional units | N/A | Download PDF | Download PDF |

| 1.27 Consistency in the application of the sum-of-costs approach | N/A | Download PDF | Download PDF |

| 1.28 Work-in-progress, transfer of ownership and capital services | N/A | Download PDF | Download PDF |

| 1.29 Add clarifications on the treatment of terminal costs during ownership transfer for different types of assets | N/A | Download PDF | Download PDF |

| 1.30 Add clarifications on the distinction between maintenance and capital repairs for intangible assets | N/A | Download PDF | Download PDF |

| 1.31 Possible alternative treatment of the transfer of leased assets at the end of the lease period | N/A | Download PDF | Download PDF |

| 1.32 Recording of share buybacks | N/A | Download PDF | Download PDF |

| 1.33 The Statistical Treatment of Negative Interest Rates | N/A | Download PDF | Download PDF |

| 1.34 Clarification on Reserve Position in the IMF | N/A | Download PDF | Download PDF |

| 1.35 Recording of Central Bank Swap Arrangements in Macroeconomic Statistics | N/A | Download PDF | Download PDF |

| 1.36 Statistical Treatment of Precious Metals Accounts | N/A | Download PDF | Download PDF |

| GFS-specific issues | |||

| 2.1 Boundary between government- controlled nonmarket producers engaged in nonfinancial activities (government units) and public nonfinancial corporations | |||

| 2.2 Boundary between government-controlled nonmarket producers engaged in financial activities (government units) and public financial corporations | |||

| 2.3 Indigenous governments | |||

| 2.4 Transactions of government with sovereign wealth funds (and similar) | |||

| 2.5 Treatment of zakat | |||

| 2.6 Further defining and subclassifying extrabudgetary units | |||

| 2.7 Treatment of government / public nonlife insurance schemes | |||

| 2.8 Debt valuation issues | |||

| 2.9 Debt assumption and debt payments on behalf of others | |||

| 2.10 Valuation and recognition of loans | |||

| 2.11 Recording of provisions and contingent liabilities | |||

| 2.12 Stock Positions and Related Flows with the IMF and other regional / international organizations | |||

| 2.13 Equity for public corporations | |||

| 2.14 Treatment of public- private partnerships (PPPs) | |||

| 2.15 Treatment of capital injections by government into corporations | |||

| 2.16 Treatment of privatization | |||

| 2.17 Boundary between capital and current transfers | |||

| 2.18 Recording and valuation of infrastructure assets | |||

| 2.19 Accounting for natural resources and their exploitation in GFS | |||

| 2.20 Climate-sustaining and climate- damaging subsidies and other transfers | |||

| 2.21 Social Security Schemes | |||

| 2.22 Government Assumption of Pension Obligations | |||

| 2.23 Employee benefits – defined benefit schemes | |||

| 2.24 A framework for the presentation of GFS metadata | |||

| 2.25 Communicating GFS to users | |||

| 2.26 Presentation of GFS flows related to natural resources | |||

| 2.27 Relationship between GFS and IPSAS | |||

| 2.28 Tax expenditures, tax deferrals, and other similar incentives | |||

| 2.29 Retained earnings of public corporations and their impact on fiscal analysis | |||

| 2.30 Methodological guidance on compilation and analyzing SOE data | |||

| 2.31 GFS within fiscal analysis and policymaking | |||

| 2.32 Balance Sheet Analysis | |||