SPECIAL DRAWING RIGHTS (SDR)

What is the SDR?

The SDR is an international reserve asset. The SDR is not a currency, but its value is based on a basket of five currencies—the US dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling.

What is the purpose of the SDR?

The IMF created the SDR as a supplementary international reserve asset in 1969, when currencies were tied to the price of gold and the US dollar was the leading international reserve asset. The IMF defined the SDR as equivalent to a fractional amount of gold that was equivalent to one US dollar.

When fixed exchange rates ended in 1973, the IMF redefined the SDR as equivalent to the value of a basket of world currencies. The SDR itself is not a currency but an asset that holders can exchange for currency when needed. The SDR serves as the unit of account of the IMF and other international organizations.

Who can hold SDRs?

Individuals and private entities cannot hold SDRs. IMF members – and the IMF itself – hold SDRs and the IMF has the authority to approve other holders, such as central banks and multilateral development banks, while individuals and private entities cannot hold SDRs. As of February 2023, there were 20 organizations approved as prescribed holders. Participating members and prescribed holders can buy and sell SDRs. However, prescribed holders do not receive allocations of SDRs, and they may not request an exchange of SDRs in transactions with designation as members do.

SDR value

The SDR value in terms of the US dollar is determined daily based on the spot exchange rates observed at around noon London time. It is posted on the IMF website.

The IMF reviews the SDR basket every five years, or earlier if warranted, to ensure that it reflects the relative importance of currencies in the world’s trading and financial systems. In the review concluded in 2015, the IMF’s Executive Board decided that the Chinese renminbi (RMB) met the criteria for inclusion in the SDR basket. In October 2016, the Chinese RMB joined the SDR basket and the three-month yield for China Treasury bonds was added to the basket used to set interest rates on SDRs.

In its reviews, the IMF considers the criteria it uses in selecting SDR basket currencies and the initial currency weights used in determining the amounts (number of units) of each currency in the SDR basket. The currency amounts remain fixed over the five-year SDR valuation period but the weights of currencies in the basket fluctuate with exchange rates among the basket currencies. The value of the SDR is determined daily based on market exchange rates.

A currency included in the SDR basket must meet two criteria:

Quinquennial SDR valuation review

In March 2021, to prioritize its work in response to the COVID-19 pandemic, the IMF Executive Board extended the SDR valuation basket to July 31, 2022, effectively resetting the five-year cycle of SDR valuation reviews. The review concluded in May 2022 maintained the composition of currencies in the SDR basket and updated their weights (for historical weights see here). The revised basket became effective on August 1, 2022

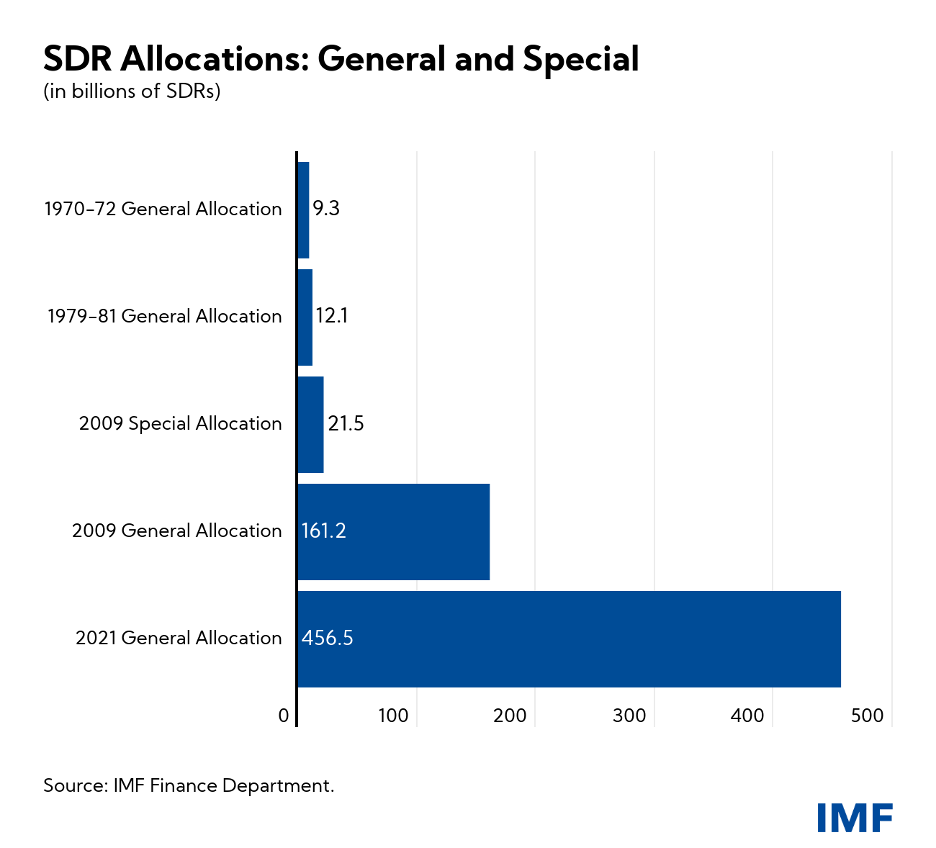

General allocations of SDRs

The Articles of Agreement allow the IMF to allocate SDRs to members – but not prescribed holders – under certain conditions. There have been four general allocations, most recently in 2021, when the IMF’s Board of Governors approved a general allocation of about SDR 456 billion, equivalent to US$650 billion, to boost global liquidity. The distribution – the largest SDR allocation in the history of the IMF – helped countries respond to the COVID-19 pandemic. The general allocation of about SDR 161 billion in 2009, equivalent to US$250 billion, boosted liquidity amid a global financial crisis.

A general allocation of SDRs requires broad support from the IMF’s members. The IMF distributes a general allocation to member countries in proportion to their quota shares at the IMF.

Special SDR allocation

The IMF made a special one-time allocation of SDR 21.5 billion (about US$33 billion) in 2009 to make the allocation of SDRs more equitable for countries that joined the IMF after 1981. At the time, those countries – more than one-fifth of the IMF’s members – had never received an SDR allocation.

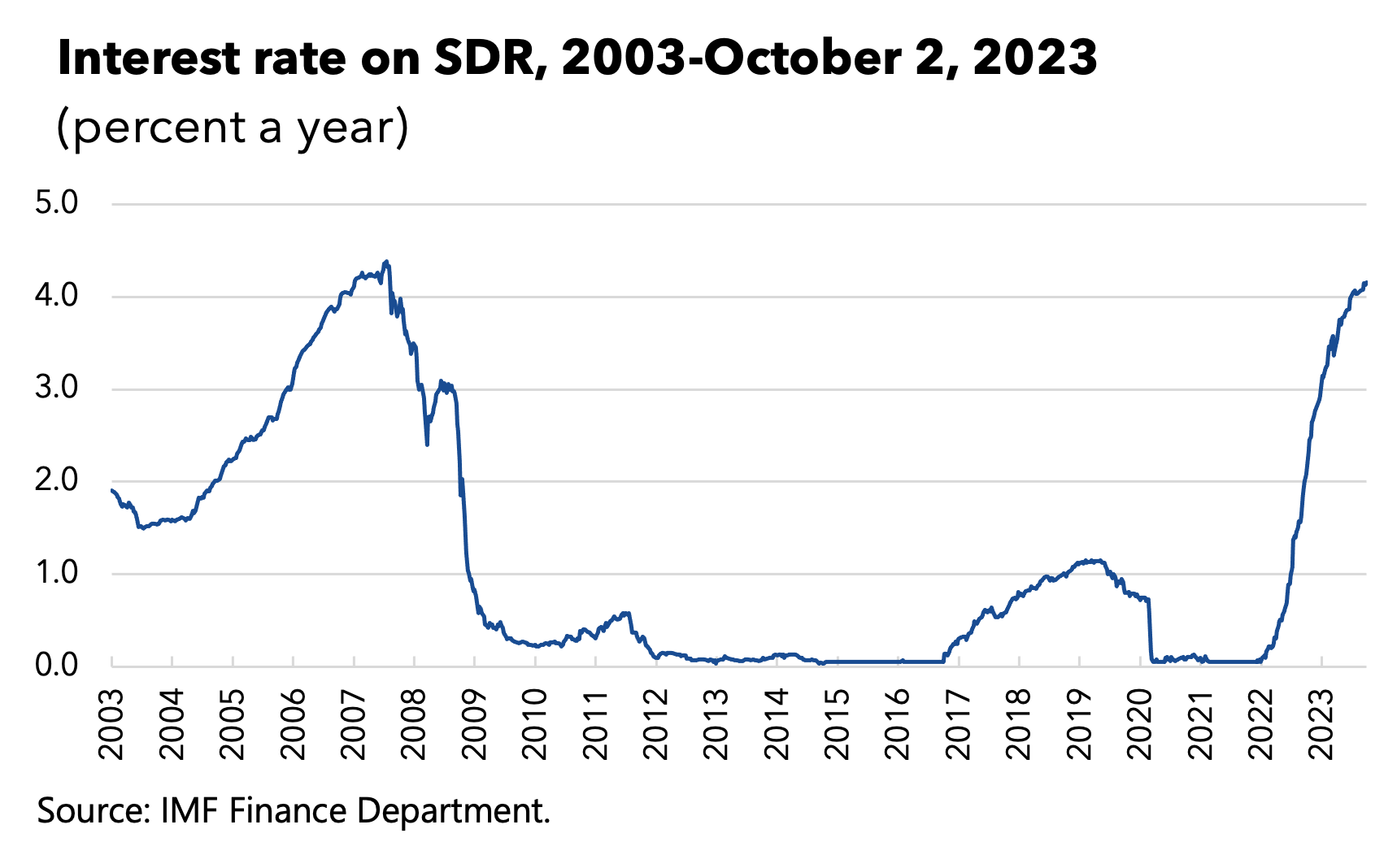

Does the IMF charge interest?

The SDR interest rate or SDRi provides the basis for calculating the interest rate charged and paid to members, including on regular borrowing from the IMF and on SDR Holdings.

It is determined weekly based on a weighted average of interest rates on three-month debt in the money markets of the SDR basket currencies.

This page was last updated in January 2023