Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : International Banking Safer Since Crisis

April 8, 2015

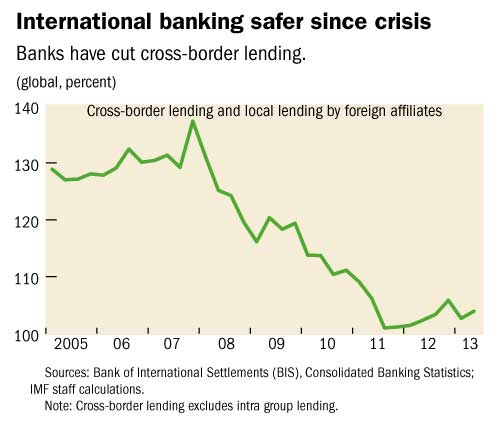

- Banks have cut cross-border lending, rely more on local lending by subsidiaries

- Makes financial systems in host countries safer

- Policymakers should promote stable international banking

International banks now rely relatively more on lending by foreign affiliates than on cross-border lending. This development may have made financial systems in host countries safer, according to new research from the International Monetary Fund.

A bank in London: global banks are lending less across borders, which is good for financial stability (photo: Reuters/Toby Melville)

Global Financial Stability Report

In new analysis that is part of the latest Global Financial Stability Report, the IMF said that cross-border lending compounds adverse domestic and global shocks to a country’s economy and financial system. Countries with higher exposure to cross-border lending experience a more significant reduction of credit growth during both domestic and global financial crises. Local lending by foreign affiliates, however, behaves differently.

How it works

In principle, lending by foreign banks can be a double-edged sword for the financial stability of a country that receives such lending (the host country). On the one hand, foreign banks are less likely to be affected by local troubles and may therefore help stabilize credit growth when host economies undergo stress. On the other hand, foreign banks are likely to transmit global shocks to host countries.

Banks generally have two ways to conduct their international lending business: directly across borders or through their foreign affiliates. In the first case, loans are made directly from headquarters to firms or other banks in another country. In the second, branches or subsidiaries (affiliates) controlled by the banking group lend to residents of the country where they are located. These two forms of international banking turn out to have very different implications for the host country’s financial stability.

While cross-border banking linkages tend to aggravate the effects of adverse domestic and global shocks on credit in host countries, local lending can play a stabilizing role during domestic crises.

“Around domestic crises, foreign-owned affiliates tend to reduce their credit less than domestic banks,” said Gaston Gelos, Chief of the Global Financial Stability Analysis Division at the IMF. “This is particularly true if the parent bank of the subsidiary is well-capitalized and has stable funding sources.”

Some banks retrench, others step in

The relative shift towards more subsidiary-based lending since the crisis is therefore likely to have positive implications for the financial stability of the host country.

Since the global financial crisis, tighter regulations on banks, both general and specific to their international operations, combined with a need to clean up balance sheets have induced banks to cut back their international lending. They have refocused on regions and financial centers that are strategically more important to them. Banks with weak balance sheets retrenched more from cross-border lending.

These developments have been driven primarily by euro area banks. The retrenchment of European banks from cross-border lending to Asia provided room for the expansion of other, more regionally-focused banks; Chinese and Japanese banks, for example, have partially filled the gap. In Africa, the expansion of pan-African banks across the continent has increased the financial linkages among African countries.

Although the reduction in cross-border lending is likely to have positive implications for financial stability, this form of international banking in principle also has benefits. For example, direct cross-border lending by global banks contributes to the allocation of global savings across countries, and helps borrowers diversify their funding sources. Policymakers should therefore act to make international banking safer.

The report’s analysis lends support to policies that foster international cooperation on cross-border resolution mechanisms to limit the risks associated with the failure of international banks.

At the same time, since local lending by affiliates is shown to be safer and more resilient, policies that encourage such type of lending are helpful. Governments can enhance the resilience to financial shocks by encouraging the subsidiaries of global banks to rely more on local funding sources.

“Since well-capitalized parent banks also contribute to the financial stability in the host country, the recent financial reforms aimed at strengthening global banks’ capital buffers help promote financial stability around the world,” Gelos said.

The IMF will release more details from its Global Financial Stability Report on April 15.