The US Economy’s Inflation Challenge

July 12, 2022

Related Links

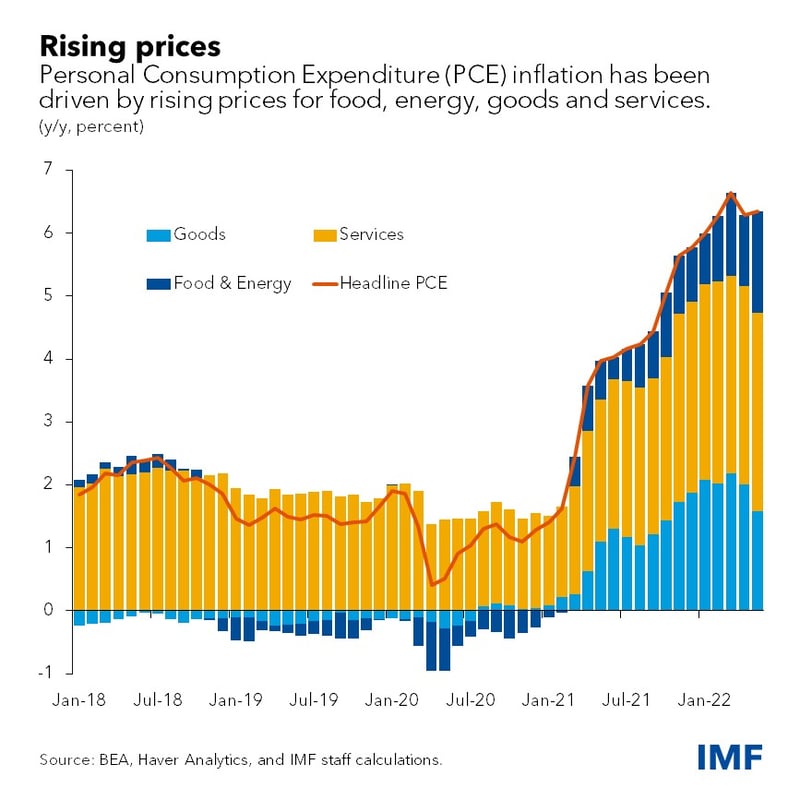

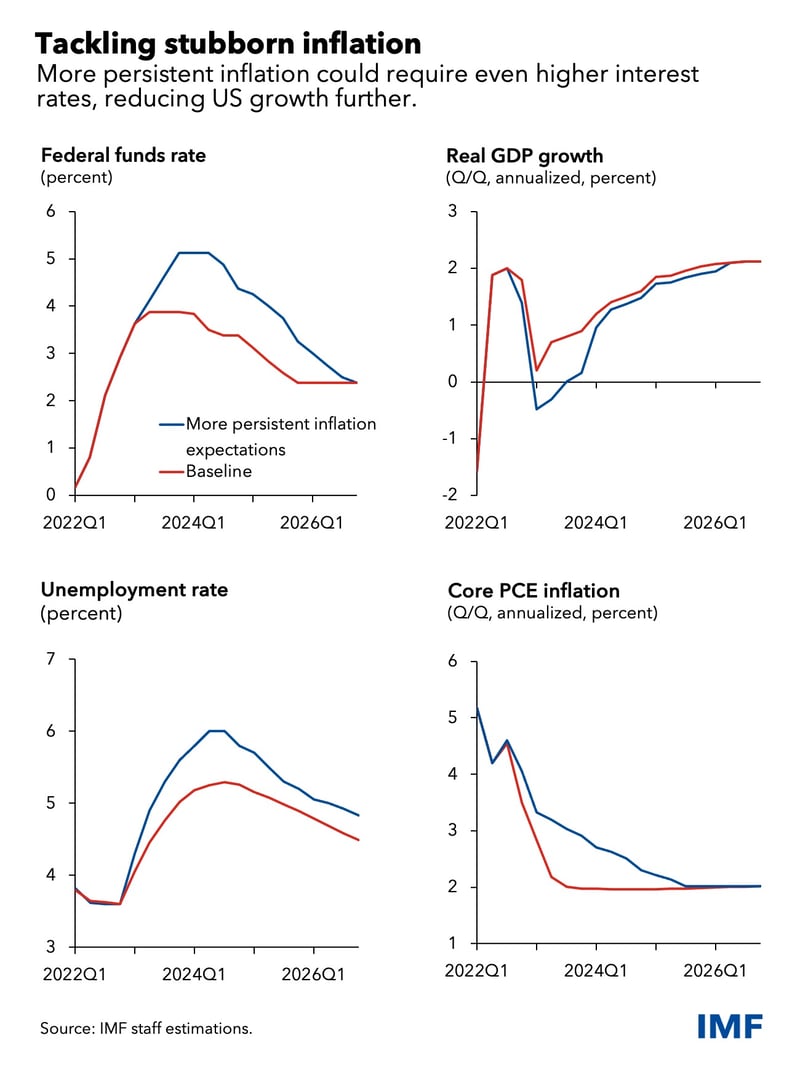

The US economy has recovered quickly from the pandemic but the bounce back in demand has stressed supply chains and caused inflation to rise sharply. The economy is expected to slow, as the Federal Reserve (the Fed) continues to tighten monetary policy and COVID economic relief programs come to an end, bringing core Personal Consumption Expenditure (PCE) inflation down to the Fed’s 2 percent medium-term target by late 2023. However, if inflation is more persistent than expected, the Fed will need to tighten more, which will further slow the economy.

The IMF’s annual review of the US economy focuses on the policies needed to return inflation to the Fed’s medium-term target. Most workers’ wages have failed to keep up with inflation, eroding the purchasing power of households and causing significant hardship. Although increases in gasoline and food prices have been affected by global events, the prices of a broader range of items have also risen strongly, including housing and transportation. If left unchecked, these price increases could become long lasting. In our assessment, we conclude that the Fed should act quickly and assertively to tackle inflation and restore price stability.

Policy action

The Fed increased its policy rates by 1.5 percent so far this year and is likely to increase them by another 2 or 2.5 percent in the coming months. It is also unwinding its holdings of Treasury bonds and mortgage-backed securities. As a result, the cost of borrowing has significantly increased. For example, the average fixed rate on a 30-year mortgage has already risen from 3 percent to between 5 and 6 percent since the start of this year. At the same time, the government is reining in spending, as a range of pandemic-era support programs are expiring.

We expect these policy actions will slow the growth in consumer spending to around zero by early next year, easing the strain on supply chains. At the same time, higher mortgage rates will reduce housing prices, which have grown strongly during the pandemic. Finally, slowing demand will increase unemployment to around 5 percent by the end of 2023, which should decrease wages.

All in all, we expect core PCE inflation to fall back toward 2 percent by late 2023, and economic activity to slow from 3.5 percent in the first quarter of this year to 0.6 percent by end‑2023.

Risks ahead

US economic developments will be impacted by global factors, such as the Russian war with Ukraine, the ongoing pandemic, and possible recurrence of shutdowns in China. Also, the longer inflation stays high, the bigger the risk that inflation expectations move up, which then feeds back into wages and prices. In that case, the Fed would need to take stronger action to bring inflation down, raising interest rates and keeping them higher for a longer period. This would lower growth further and lead to higher unemployment.

An inclusive recovery

While the Fed policies required to lower inflation may result in short-term costs on households and firms, they will help restore price stability and lay the foundations for strong economic growth and low unemployment. To support growth over the medium to long term, the US government can use fiscal measures to invest in reforms to expand the size of the labor force, improve productivity, and incentivize innovation and investment. These could include increased government support for paid family leave, childcare, pre-school, and access to a college education; tax credits that help women, minorities, and lower-income workers join the workforce; and immigration reform that is targeted toward expanding the labor force and strengthening skills.

****

Andrew Hodge is an Economist in the IMF’s Western Hemisphere Department.