The Unexpected Rise in Remittances to Central America and Mexico During the Pandemic

September 21, 2022

Remittances hit record levels in 2021 driven by rising US wages and unemployment insurance relief

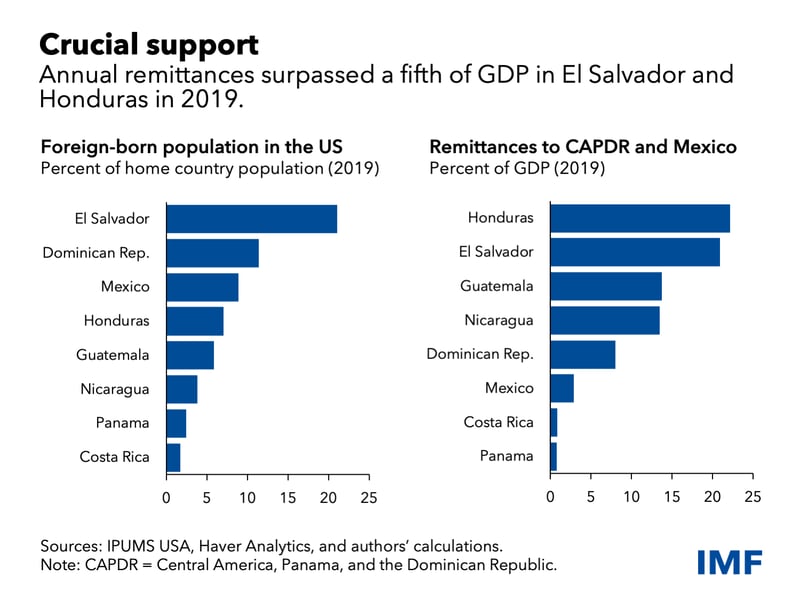

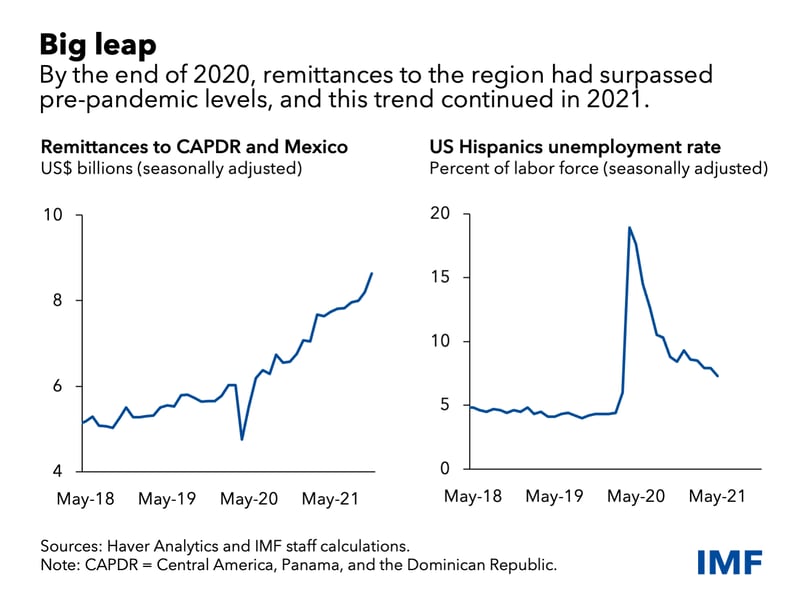

Remittances—the money sent from citizens working abroad to families back home—are a crucial source of income in Central America, Panama, and the Dominican Republic (CAPDR) as well as Mexico. Despite an expected decline at the onset of the pandemic, remittances surprisingly increased in 2020, hitting record levels in 2021. IMF staff research explores why remittances from the US to CAPDR and Mexico remained resilient during the pandemic.

An unexpected comeback

Remittances to CAPDR and Mexico are sent by immigrants working predominantly in the service-providing sectors of the US economy. Economists predicted that remittances to CAPDR and Mexico would decline by up to 20 percent, given the fall in US employment at the onset of the pandemic. They based this prediction on the data from traditional macroeconomic models that linked US labor market conditions with immigrants’ income. These models accurately predicted the deep but brief collapse in remittances that we observed in April 2020, but they failed to predict the strong comeback that followed.

Explaining the surge

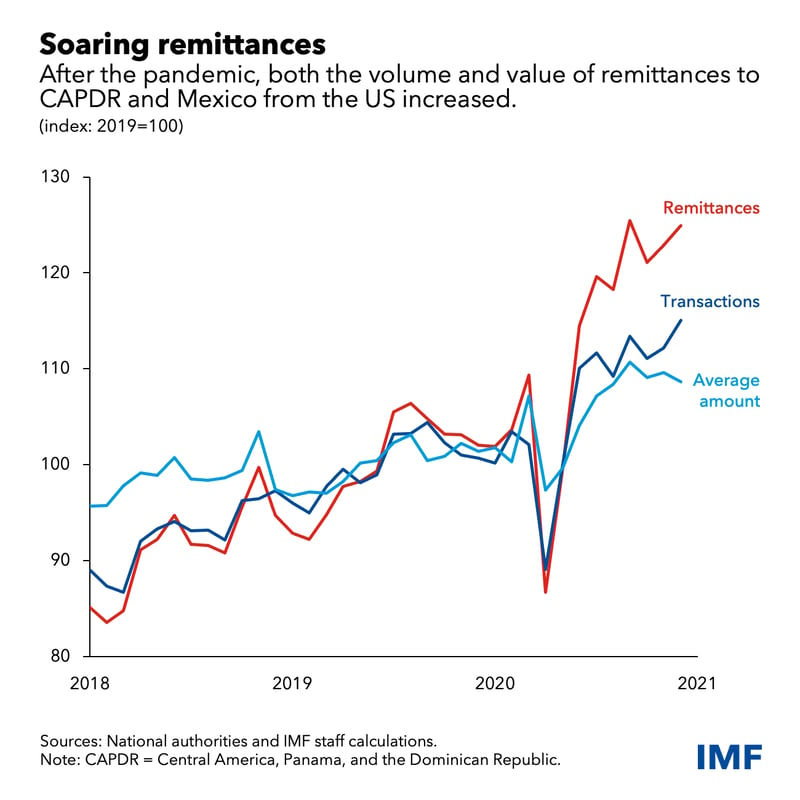

Before the pandemic, the number of remittance transactions—the volume effect—determined the level of remittances. The jump in remittances observed in the second half of 2020 was a result of an increase in both the number of transactions and the average amount remitted per transaction—the value effect.

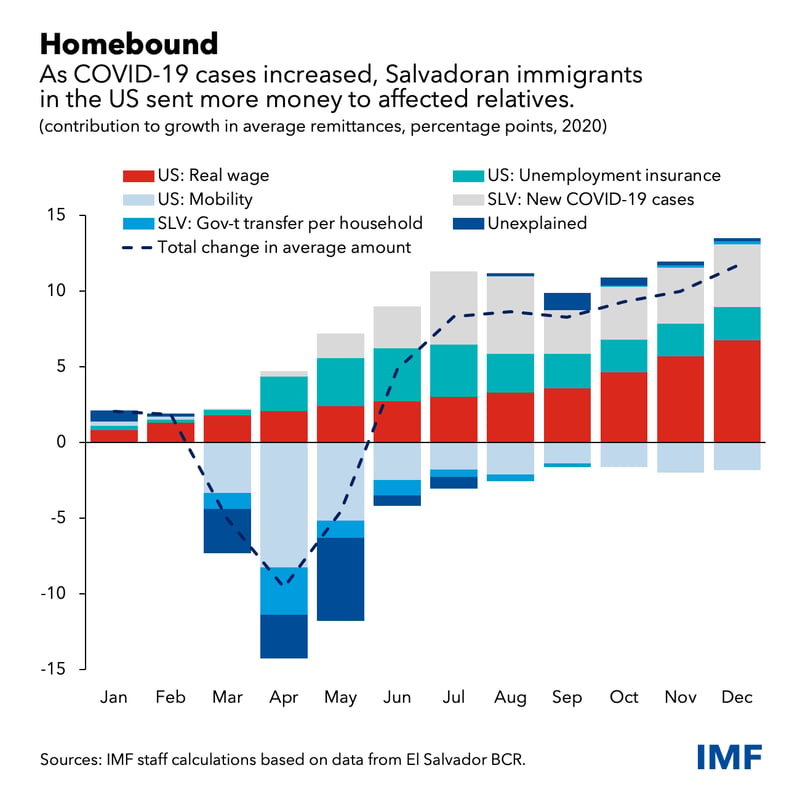

The rise in the number of transactions—the volume effect—was most likely driven by an increase in the number of people sending remittances rather than new immigrants arriving in the US. As a result of the lockdowns, immigrants also adapted and switched to remitting digitally, rather than in person, increasing the number of transactions. More importantly, most of the increase in remittances was due to the value effect. Rising US wages drove the increase in the average amounts remitted. US government assistance, through unemployment insurance relief, also supported incomes and compensated for the loss of income, contributing to the increase. The “altruism” motive was very strong; as COVID-19 cases were increasing at home, immigrants in the US sent on average more money home.

A look ahead

Looking forward, the growth in remittances to CAPDR and Mexico is expected to slow, as some of the extraordinary factors in 2020 and 2021 dissipate. However, over time remittances are expected to grow, as immigration to the US continues to rise and the average amount remitted grows in line with US wages. If employment and wages remain strong in the US, we should expect an increase in remittances during times of hardship in Central America and Mexico, as immigrants help families back home.

****

Yorbol Yakhshilikov is an economist in the IMF Western Hemisphere Department.