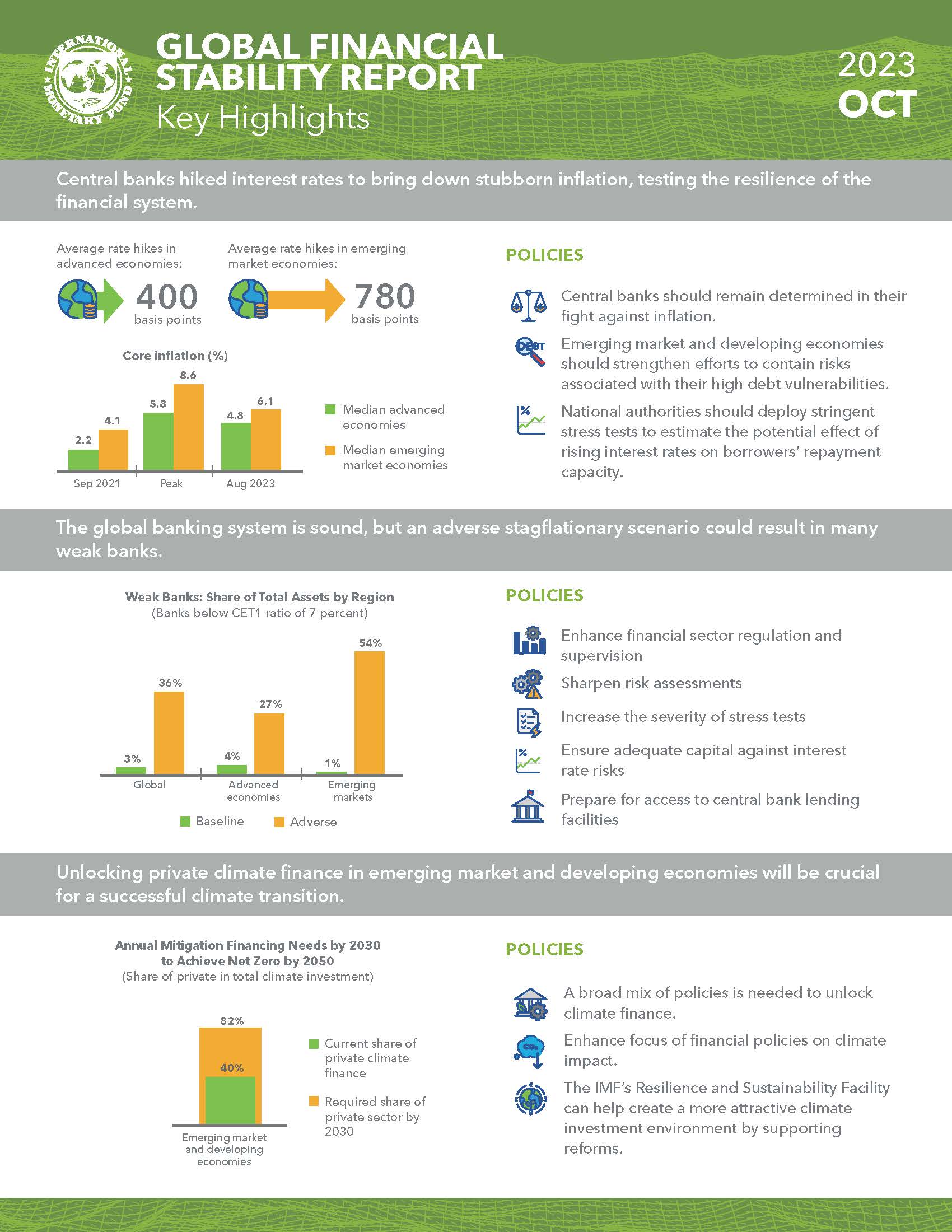

Risks to global growth remain skewed to the downside as inflation remains elevated and interest rates are set to stay higher for longer.

Chapter 1 assesses that risks to global growth are skewed to the downside, similar to the assessment in the April 2023 Global Financial Stability Report. Cracks in the financial system may turn into worrisome fault lines should a soft landing of the global economy hoped for by market participants does not materialize.

Chapter 2 homes in on the global banking system, providing a fresh assessment of vulnerabilities in a higher-for-longer environment, using an enhanced global stress test and a set of newly developed market-based indicators. In response to the vulnerabilities that are uncovered, enhancements to supervisory practices and tightening of regulatory standards are proposed.

Chapter 3 notes that a broad mix of policies is required to unlock the private capital necessary to cover climate mitigation investment needs in emerging market and developing economies.

Chapter 1: Soft Landing or Abrupt Awakening?

With core inflation still high in many advanced economies, central banks may need to keep monetary policy tighter for longer than is currently priced in markets. In emerging market economies, progress on lowering inflation appears to be more advanced, though there are discrepancies across regions. Yet, optimism about a “soft landing” of the global economy, whereby disinflation continues apace and a recession is avoided, has eased financial conditions since the April 2023 Global Financial Stability Report—stock markets have rallied, credit spreads have remained tight, and emerging market currencies have appreciated. Upside surprises to the inflation outlook would challenge the soft-landing narrative, resulting in a potentially sharp repricing of assets. While acute stress in the global banking system has subsided, a weak tail of banks remains in some countries. Cracks in other sectors may also become apparent and could turn into worrisome fault lines that would again test the resilience of the global financial system in the event of an abrupt tightening of financial conditions. Most notably, the global credit cycle has started to turn as borrowers’ debt repayment capacity diminishes and credit growth slows. Risks to global growth are therefore skewed to the downside, similar to the assessment in April.

Chapter 2: A New Look at Global Banking Vulnerabilities

Chapter 2 provides a fresh assessment of global banking vulnerabilities in a higher-for-longer environment. A global stress test that has been enhanced to draw lessons from the March 2023 banking turmoil uncovers many banks in advanced economies with the potential for significant capital losses, driven by marking-to-market securities and provisioning for loan losses. These results are consistent with a set of newly developed indicators, based on market data and analyst forecasts, which point to a substantial group of smaller banks at risk in the United States, and risks increasing in Asia, China, and Europe. In response to these vulnerabilities, policy makers should sharpen their risk assessments, increase the severity of stress tests and increase capital held against interest rate risks, and banks should ensure that they are prepared to access central bank facilities in times of stress.

Chapter 3: Financial Sector Policies to Unlock Private Climate Finance in Emerging Market and Developing Economies

The private sector will have to cover a major share of the large climate mitigation investment needs in emerging market and developing economies (EMDEs). EMDEs face challenges in attracting private climate finance such as their often low credit rating, which limits the potential investor base. Climate policies of major banks and insurance companies are not yet aligned with net zero emission targets. Despite the growth in sustainable investment funds, a small share of the invested money is dedicated to creating a positive climate impact. Given the political hurdles to implementing carbon pricing and EMDE-specific challenges, a broad mix of policies is needed to create an attractive environment for private climate mitigation finance in EMDEs. Structural policies are key to lowering the cost of capital, mobilizing domestic financial resources, and improving credit ratings in EMDEs. Another essential part of the policy mix is financial sector policies, which should refocus on creating climate impact and consider the specific circumstances of EMDEs. In low-income countries additional international support and policy initiative will be needed. The IMF Resilience and Sustainability Facility, by supporting reforms, can help create an enabling investment environment and attract private capital.

Publications

-

March 2024

Finance & Development

-

ECONOMICS

How should it change?

-

September 2023

Annual Report

- COMMITTED TO COLLABORATION

-

Regional Economic Outlooks

- Latest Issues